GameStop Trading Slightly Lower Today, Despite Impressive Q1 Results

Shares of American video game, consumer electronics, and gaming merchandise retailer GameStop (GME) dropped by 1.61% on Monday. However, the stock is still up more than 1,000% year-to-date after a 200% plus rally in 2000.

Last week, the company delivered impressive Q1 results. Net sales were up 25.1% to $1.28 billion, topping consensus estimates of $1.16 billion. The company also delivered an adjusted net loss of $0.45 a share against analysts' net loss expectations of $0.83 a share. (See GameStop stock analysis on TipRanks)

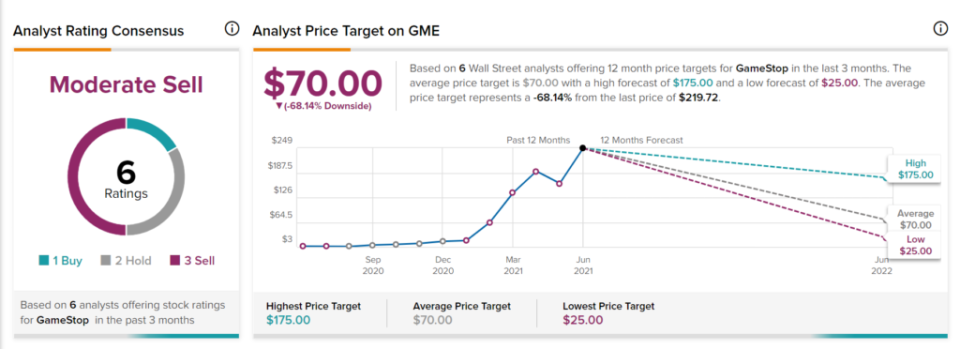

Consensus among analysts is a Moderate Sell, based on 1 Buy, 2 Holds and 3 Sells. The average analyst GameStop price target of $70 implies 68.86% downside potential from current levels.

Related News:

State Street Provides Upbeat Guidance for Q2 Revenues; Shares Gain 1.3%

Coinbase Partners with 401(k) Advisor; Shares Climb 6.8%

ContextLogic Inks Partnership Deal with PrestaShop; Shares Pop 12.7%