GDX Put Buyer Braces for a Big Retreat

Gold prices have been surging since June amid increasing U.S.-China trade tensions and signs of a slowing global economy. This positive price action has been seen in the VanEck Vectors Gold Miners ETF (GDX), which tapped a three-year high at $30.96 on Sept. 4. The exchange-traded fund (ETF) has since eased back from this peak, and one options trader is positioned for more short-term downside.

Taking a look at Wednesday's options activity shows GDX puts crossed at 1.8 times the average daily pace, with around 102,000 contracts traded. The December 23 put was most active, due to two blocks totaling 30,028 contracts that changed hands above the ask price for $0.25 apiece.

If these puts were bought to open, the initial cash outlay for the speculator was $750,700 (number of contracts * premium paid * 100 shares per contract). This is the most the put buyer stands to lose, should GDX settle north of $23 at December options expiration.

Profit, meanwhile, will accumulate on a move below breakeven at $22.75 (strike less premium paid). However, it's possible the activity at this deep out of the strike came at the hands of shareholders initiating a protective put, meaning their long-term goal is for gold to keep rising.

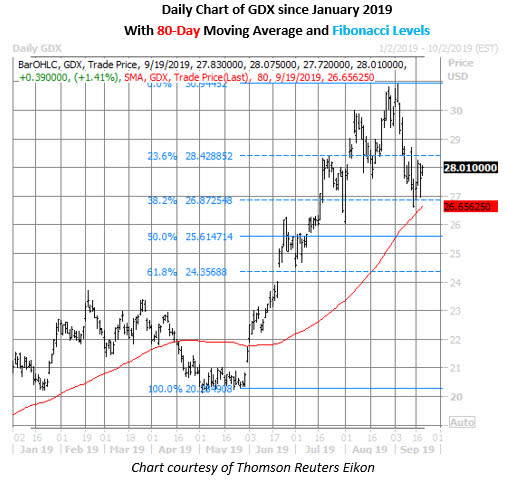

Looking closer at the charts, GDX's pullback from its early September high stalled out near $27 -- a region that contained an early August retreat, and is home to a 38.2% Fibonacci retracement of the fund's surge from its late-May lows near $20 to that recent peak. Just below here is its rising 80-day trendline, which helped usher GDX higher in the first quarter. Year-to-date, the shares are up 32.7% to trade at $28.01.