Some Gemini Investments (Holdings) (HKG:174) Shareholders Are Down 40%

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Gemini Investments (Holdings) Limited (HKG:174), since the last five years saw the share price fall 40%. And we doubt long term believers are the only worried holders, since the stock price has declined 21% over the last twelve months. Unhappily, the share price slid 12% in the last week.

View our latest analysis for Gemini Investments (Holdings)

Given that Gemini Investments (Holdings) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Gemini Investments (Holdings) saw its revenue increase by 22% per year. That's better than most loss-making companies. The share price drop of 9.7% per year over five years would be considered let down. So you might argue the Gemini Investments (Holdings) should get more credit for its rather impressive revenue growth over the period. So now is probably an apt time to look closer at the stock, if you think it has potential.

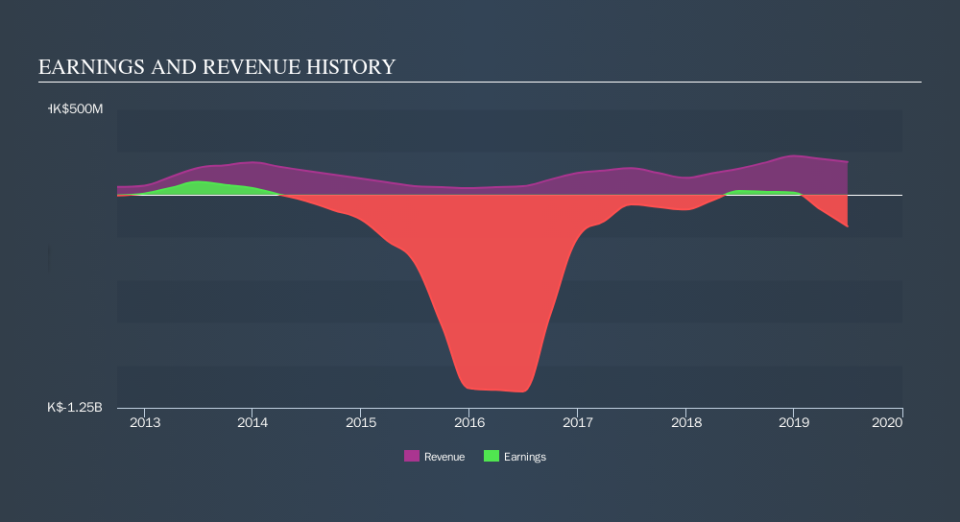

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Gemini Investments (Holdings)'s earnings, revenue and cash flow.

A Different Perspective

We regret to report that Gemini Investments (Holdings) shareholders are down 21% for the year. Unfortunately, that's worse than the broader market decline of 0.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Gemini Investments (Holdings)'s growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Gemini Investments (Holdings) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.