Is Genco Shipping & Trading (NYSE:GNK) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Genco Shipping & Trading Limited (NYSE:GNK) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Genco Shipping & Trading

What Is Genco Shipping & Trading's Debt?

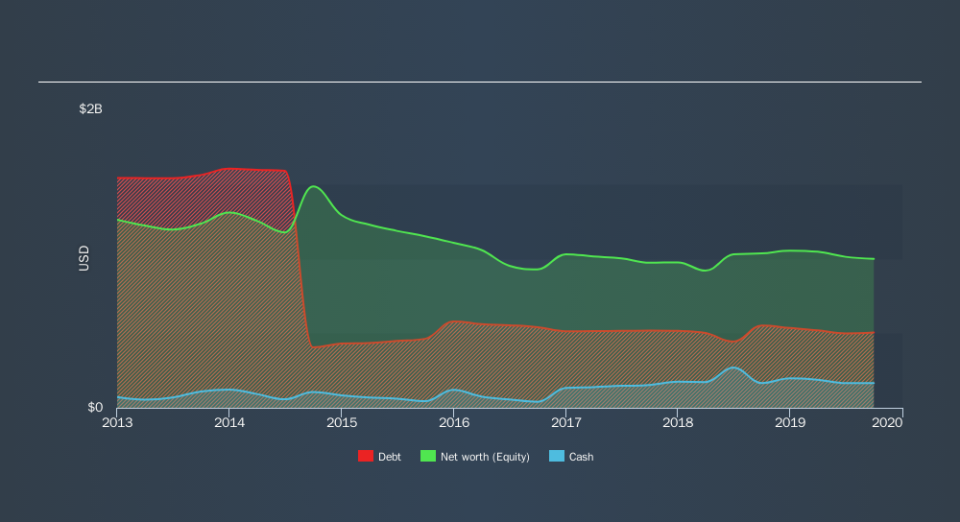

As you can see below, Genco Shipping & Trading had US$504.6m of debt at September 2019, down from US$554.4m a year prior. On the flip side, it has US$165.9m in cash leading to net debt of about US$338.7m.

How Strong Is Genco Shipping & Trading's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Genco Shipping & Trading had liabilities of US$119.2m due within 12 months and liabilities of US$444.7m due beyond that. Offsetting these obligations, it had cash of US$165.9m as well as receivables valued at US$20.4m due within 12 months. So it has liabilities totalling US$377.7m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of US$477.3m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Genco Shipping & Trading's debt to EBITDA ratio (4.1) suggests that it uses some debt, its interest cover is very weak, at 0.46, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, Genco Shipping & Trading's EBIT was down 66% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Genco Shipping & Trading's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Genco Shipping & Trading saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Genco Shipping & Trading's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. After considering the datapoints discussed, we think Genco Shipping & Trading has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Even though Genco Shipping & Trading lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.