General Dynamics: Improved Profitability and Undervalued Stock

- By Nathan Parsh

Shares of aerospace and defense company General Dynamics Corporation (NYSE:GD) have declined 18.5% year-to-date and sit more than 24% off the 52-week high.

The company's aerospace segment has been weak over the past few quarters as new orders for Gulf Stream jets have slowed. With the economy in a delicate position due to the coronavirus pandemic, private jet orders have been out as well.

Covid-19 has also impacted General Dynamics' Information Technology business as business travel and site access resulted in a 13% year-over-year decline in the most recent quarter. These two segments account for almost half of the company's total business.

This helps explain the decline that has occurred in the stock in 2020. However, for investors with a horizon that spans longer than a few quarters, this could be an excellent opportunity to add General Dynamics to their portfolio.

Eventually, a recovery from Covid-19 will take place, which should ease the pressure on both the Aerospace and Information Technology segments. General Dynamics should benefit from increased defense spending that is occurring both in the U.S. and around the world.

Even with the headwinds it is facing, General Dynamics is a highly profitable company that I consider to be undervalued at the moment.

Company background and historical performance

General Dynamics is one of the largest aerospace and defense companies found anywhere in the world. The company consists of five business segments: Aerospace, Information Technology, Marine Systems, Combat Systems and Mission Systems. General Dynamics supplies military vehicles like the M1 Abrams Tanks, Virginia and Columba-class submarines and Gulf Stream jets. The company generated nearly $39 billion in revenue over the last four quarters and has a current market capitalization of $41 billion.

General Dynamics' revenue had been choppy for much of the last decade before accelerating higher over the past few years. This has coincided with higher defense spending, especially in the U.S. Revenue has compounded at an annual rate of just 2% over the last decade. The annual rate increases to 8.3% over the last three years.

On the other hand, earnings per share has grown quite steadily over the last 10 years, compounding at an annual rate of nearly 6% over this period of time. Only twice in the last decade has EPS declined compared to the previous year (2012 and 2017).

Share buybacks have reduced the float by 2.5% per year since 2010, but net profit has increased every year except 2011, 2012 and 2017.

I am leery of companies that rely on buybacks to prop up EPS, but General Dynamics has also been able to grow its profits as well.

General Dynamics receives a score of 7 out 10 by the GuruFocus system in terms of profitability. This rating is led by a return on equity that is higher than 93% of the companies in the aerospace and defense industry. ROE is also near the top end of General Dynamics' historical range. The operating margin also ranks well against peers even if it is weaker than General Dynamics' typical score.

The revenue growth over the last decade is underwhelming, especially considering that much of this has taken place over the last three years. EPS has increased at a mid-single-digit pace and has been aided by share repurchases.

That said, General Dynamics does compare quite favorably to is peers in every subcategory of the profitability rank, which is what I am looking for when it comes to an investment in an industry. I want to own companies that outperform their peers.

Dividend analysis

General Dynamics raised its dividend by 7.8% for the dividend distributed May 8. The company has increased its dividend for the past 29 years, the longest streak in the aerospace and defense industry.

General Dynamics' dividend has increased with a compound annual growth rate of:

6.7% over the past three years.

8.1% over the past five years.

9.3% over the past 10 years.

The most recent increase falls in between the three and five-year CAGR, showing that dividend growth remains solid.

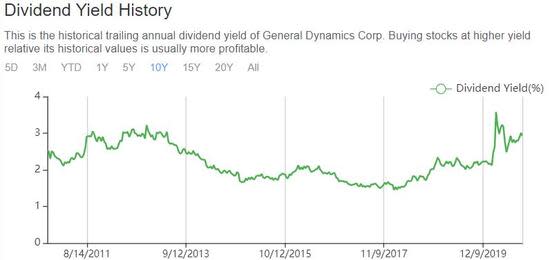

General Dynamics receives solid marks from the GuruFocus system when it comes to its dividend and buy backs. The current yield is higher than 70% of the companies in the aerospace and defense industry and near the upper range of the stock's own historical average. The share buy back also outpaces more than 90% of peers.

General Dynamics' forward yield of 3% is better than its average yield of 2.3% that the stock has traded with since 2010. As you can see above, shares have rarely traded with a higher yield over the last decade.

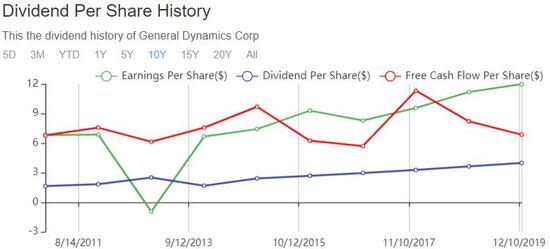

General Dynamics' EPS growth may have been somewhat inconsistent over the last 10 years, but it has almost always more than covered the company's dividend payments. Free cash flow has been inconsistent over this period as well, but offers more than enough cushion for dividend payments and raises.

General Dynamics has distributed $4.24 of dividends per share over the last four quarters while producing adjusted EPS of $11.26 over that same period of time, resulting in an EPS payout ratio of 38%. This is a solid payout ratio, even if it is slightly higher than the 10-year average payout ratio of 31%.

The company has distributed $1.2 billion of dividends to shareholders over the last four quarters while generating free cash flow of $2.6 billion, which equates to a free cash flow payout ratio of 46%. This is within shouting distance of the free cash flow payout ratio of 42% that General Dynamics averaged between 2016 and 2019.

Both the EPS and free cash flow payout ratios are somewhat higher than the longer-term averages, but still within a very safe range that makes it likely that General Dynamics will be able to raise its dividend for years to come. The company's growth streak is best in its industry and should remain that way given the state of the payout ratios. Investors buying today are buying a safe dividend and a higher than usual dividend yield.

Recession performance

General Dynamics weathered the Great Recession and even performed quite well. The company's EPS results for the years before, during and after last recession are listed below:

2006 EPS: $4.20

2007 EPS: $5.10 (21% increase)

2008 EPS: $6.13 (20% increase)

2009 EPS: $6.20 (1.1% increase)

2010 EPS: $6.82 (9% increase)

2011 EPS: $6.94 (1.8% increase)

General Dynamics stacked back-to-back 20%+ increases during the first two years of the last recession, an impressive feat during a difficult economic period of time. EPS growth slowed dramatically in 2009, but remained positive. Even taking into account stock repurchases, net income still increased more than 16% from 2007 through 2009. Again, this is a solid performance during a very turbulent time.

At the same time, General Dynamics continued its run of dividend growth. Listed below are the company's dividends paid before, during and after the last recession.

2006 dividends: $0.89

2007 dividends: $1.10 (19% increase)

2008 dividends: $1.40 (27% increase)

2009 dividends: $1.52 (8.6% increase)

2010 dividends: $1.68 (10.5% increase)

2011 dividends: $1.88 (12% increase)

General Dynamics' dividend growth remained strong through the last recession. This should reassure shareholders that the dividend will continue to grow during the next recession.

Debt

General Dynamics receives a middle of the road score for its financial strength from the GuruFocus system.

The company's financial strength is rated as a 5 out of 10. This is driven by a cash-to-debt score that is lower than 78% of industry peers. General Dynamics cash and equivalents finished below $1 billion in both 2019 and 2018 while total debt nearly tripled. This is the likely culprit for the low rating in this area.

The increase in debt over the past few years isn't as much a burden on the company as you might think. Interest expense over the last four quarters was just $107 million. With total debt at $16 billion as of the end of the last quarter, the weighted average interest rate is less than 1%. The increase in debt shouldn't have much impact on General Dynamics' ability to maintain its dividend.

Valuation

General Dynamics closed Monday's trading session at $144.73. With Wall Street analysts surveyed by Yahoo Finance expecting $11.04 of EPS, shares have a forward price-earnings ratio of 13.1. The average price-earnings ratio since 2010 is 14. The five-year average multiple is even higher at 16.7 times earnings.

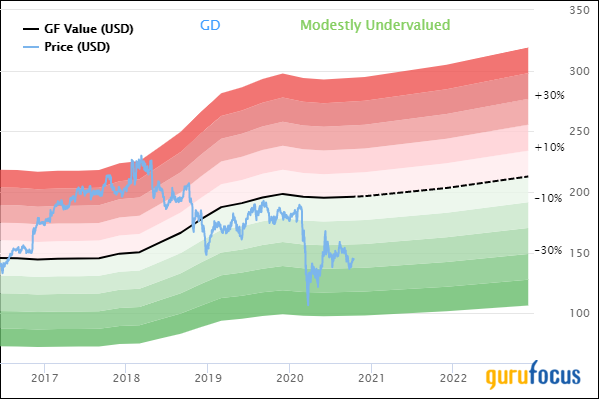

The GuruFocus Value Line also finds General Dynamics modestly undervalued.

If you're not familiar with the GF Value Line, it represents an estimation of the current intrinsic value of a stock based on a variety of factors, including price-earnings ratio, price-to-free-cash-flow, the company's past returns and future estimates of business performance.

As of Monday, GuruFocus finds that General Dynamics has a GF Value of $195.15 per share, resulting in a price-GF-Value of 0.74. This means that the stock has a rating of modestly undervalued. Reaching the GF Value would result in a share price appreciation of nearly 26% from yesterday's closing price.

Final thoughts

Shares of General Dynamics have struggled in 2020. This pressure should eventually fade while defense spending should offset weakness until a recovery takes place.

General Dynamics has a rich dividend growth history and solid payout ratios that should mean future raises as well. The company is also fairly recession proof.

Using either the company's historical price-earnings ratio or the GF Value, the stock remains undervalued and could offer a solid return on investment. As such, I continue to believe that General Dynamics is a solid buy for investors looking for exposure to the aerospace and defense sector.

Author disclosure: the author has a long position in General Dynamics.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.