George Soros' Top 6 Buys in 3rd Quarter

- By James Li

George Soros (Trades, Portfolio), leader of Soros Fund Management LLC, disclosed this week his top six buys for the third quarter were Tribune Media Co. (TRCO), Archer-Daniels Midland Co. (ADM), Walt Disney Co. (DIS), The Kraft Heinz Co. (KHC), Mondelez International Inc. (MDLZ) and Micron Technology Inc. (MU).

Warning! GuruFocus has detected 4 Warning Signs with TRCO. Click here to check it out.

The intrinsic value of TRCO

Soros focuses on a theory of reflexivity: the prices of stocks, bonds and currencies depend on the people who buy them and that traders often act out of highly emotional reactions rather than coolly logical calculations.

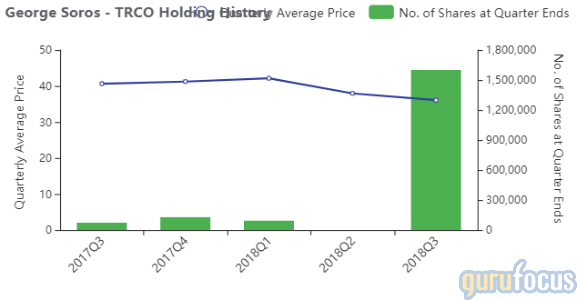

Tribune Media

Soros invested in 1.6 million shares of Tribune Media, a New York-based media and entertainment company. Shares averaged $36.06 during the quarter.

CEO Peter Kern said on Nov. 9 that the company "drove share gains in political and core advertising" during the quarter, contributing to consolidated revenues of $498 million, up 11% from the prior-year quarter. GuruFocus ranks the company's profitability 7 out of 10 on several good indicators, which include a satisfactory Piotroski F-score of 6 and net profit margins outperforming 94% of global competitors.

Baupost Group manager Seth Klarman (Trades, Portfolio) invested in 3 million shares of Tribune during the quarter, boosting his position to 5,996,042 shares.

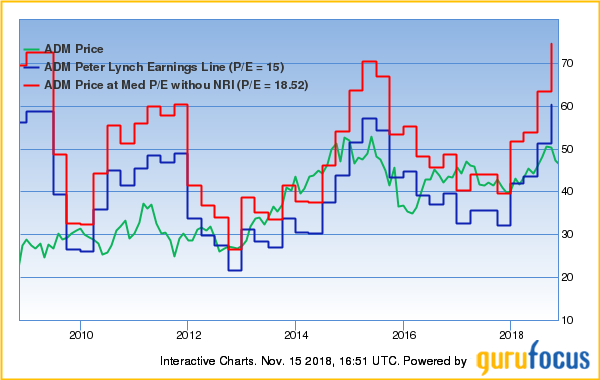

Archer-Daniels Midland

Soros invested in 720,000 shares of Archer-Daniels Midland, a major processor of oilseeds, corn, wheat and other agricultural commodities. Shares averaged $49.06 during the quarter.

GuruFocus ranks the Chicago-based company's profitability 5 out of 10: although the company's Piotroski F-score ranks 7 out of 9, its operating margin and three-year revenue growth rate underperform over two-thirds of global competitors.

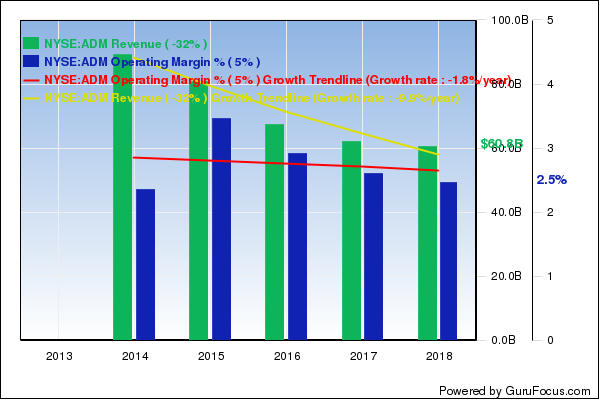

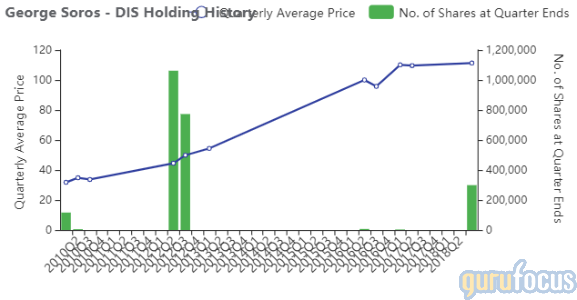

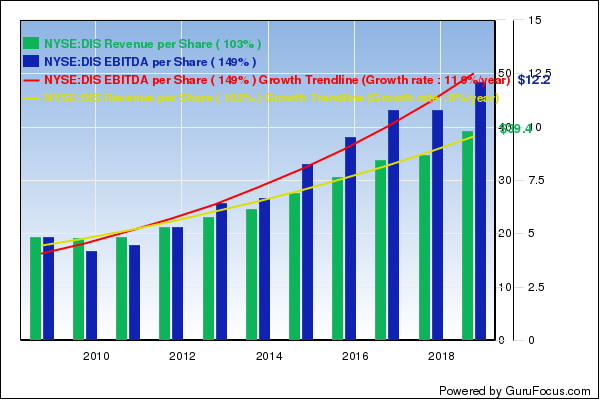

Walt Disney

Soros invested in 299,000 shares of Walt Disney, a Burbank, California-based entertainment company tied to a potential acquisition of Twenty-First Century Fox Inc. (FOXA)(FOX). Shares of Disney averaged $111.30 during the quarter.

GuruFocus ranks the company's profitability 9 out of 10 on several positive indicators, which include expanding profit margins and a strong Piotroski F-score of 8. Additionally, Disney's business predictability ranks 4.5 stars out of five on strong and consistent revenue and earnings growth over the past 10 years.

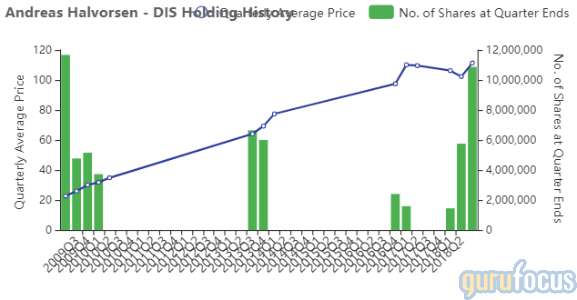

Viking Global Investors Chief Investment Officer Andreas Halvorsen (Trades, Portfolio) added 5,116,214 shares of Walt Disney during the quarter, boosting his position to 10,868,535 shares.

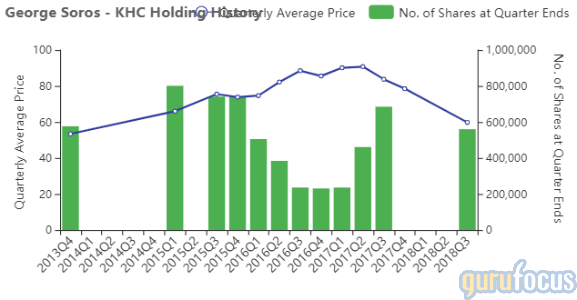

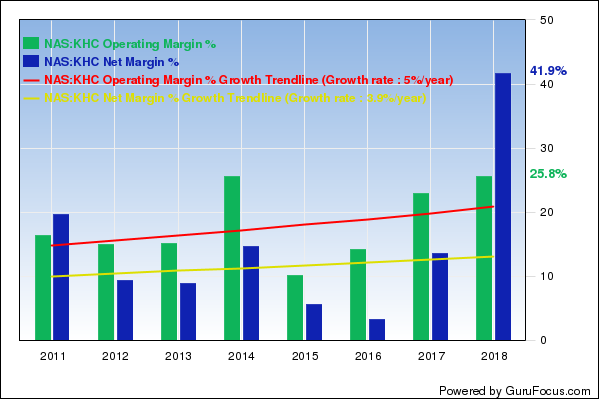

Kraft Heinz

Soros invested in 560,000 shares of Kraft Heinz, a major holding of Berkshire Hathaway Inc. (BRK-A)(BRK-B) CEO Warren Buffett (Trades, Portfolio). Shares of the Chicago-based packaged foods company averaged $59.78 during the quarter.

CEO Bernardo Hees said on Nov. 1 the company's solid results for the quarter reflected continued strength in its pipeline of marketing, new product and whitespace initiatives in the marketplace. GuruFocus ranks the company's profitability 6 out of 10: even though revenues have declined 11.1% over the past three years, Kraft Heinz has expanding profit margins and a strong Piotroski F-score of 7.

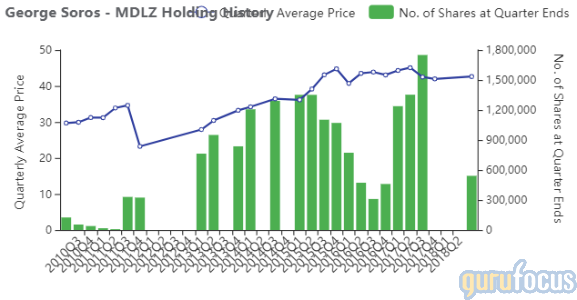

Mondelez

Soros invested in 541,700 shares of Mondelez, the parent company of well-known brands like Oreos and Chips Ahoy. Shares averaged $42.63 during the quarter.

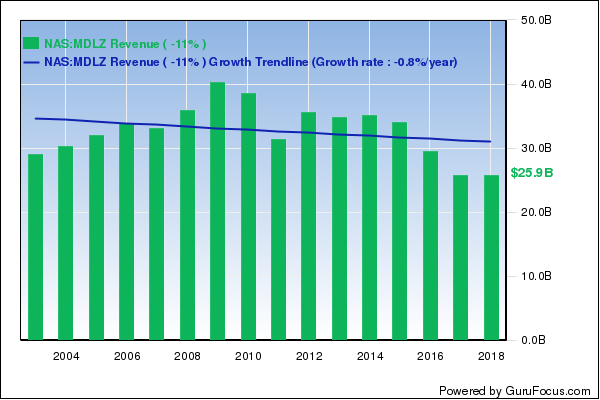

The Deerfield, Illinois-based company said on Oct. 29 that net revenues declined 3.7% primarily due to headwinds from currency and malware effects in the prior year. The decline in revenues contributed to a three-year revenue decline rate of 5.5%, which underperforms 77% of global competitors.

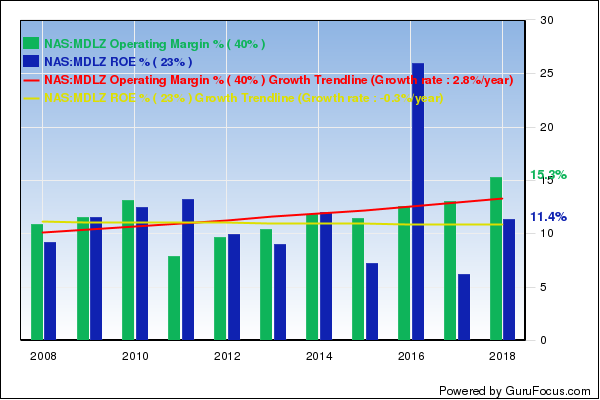

Despite declining revenues, Mondelez's profitability still ranks a solid 6 out of 10 on expanding profit margins and a strong Piotroski F-score of 8.

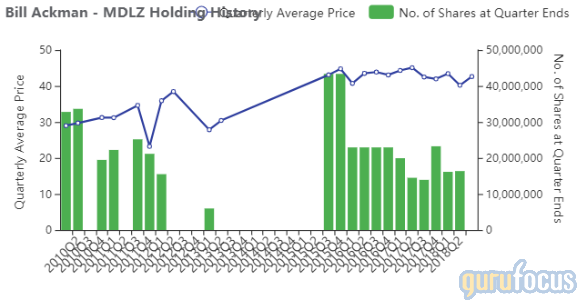

Pershing Square fund manager Bill Ackman (Trades, Portfolio) closed his position in Mondelez during the quarter, selling 16,371,713 shares.

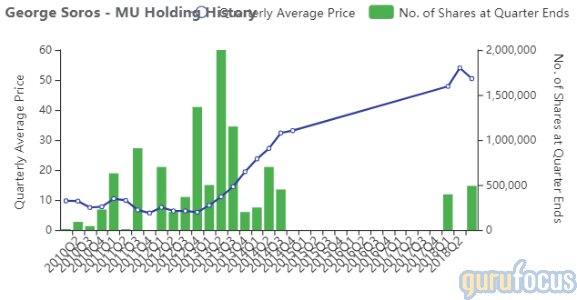

Micron Technology

Soros invested in 490,100 shares of Micron Technology, a major David Tepper (Trades, Portfolio) holding. Shares averaged $50.44 during the quarter.

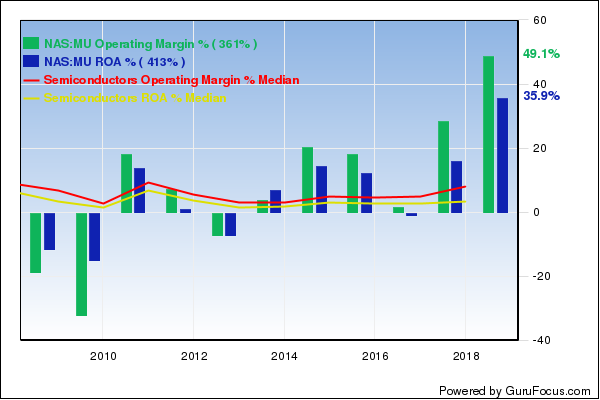

GuruFocus ranks Micron Technology's profitability 10 out of 10 on several positive investing signs, which include expanding profit margins, an excellent Piotroski F-score of 8 and a return on assets close to a 10-year high of 35.51%.

Yacktman Asset Management (Trades, Portfolio) also established a position in Micron Technology during the quarter.

See also

GuruFocus has launched a new version of our guru pages that allows you to have multiple guru tabs open. For example, you can have Soros, Buffett and Klarman open directly on one Chrome window.

Disclosure: No positions.

Read more here:

Warren Buffett's Berkshire Buys 4 Stocks, Sells Walmart in 3rd Quarter

How Seth Klarman Values Businesses

Fairfax's Prem Watsa Goes 2 for 2 in 3rd Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with TRCO. Click here to check it out.

The intrinsic value of TRCO