German Business Outlook Inches Higher But Remains Gloomy

- Oops!Something went wrong.Please try again later.

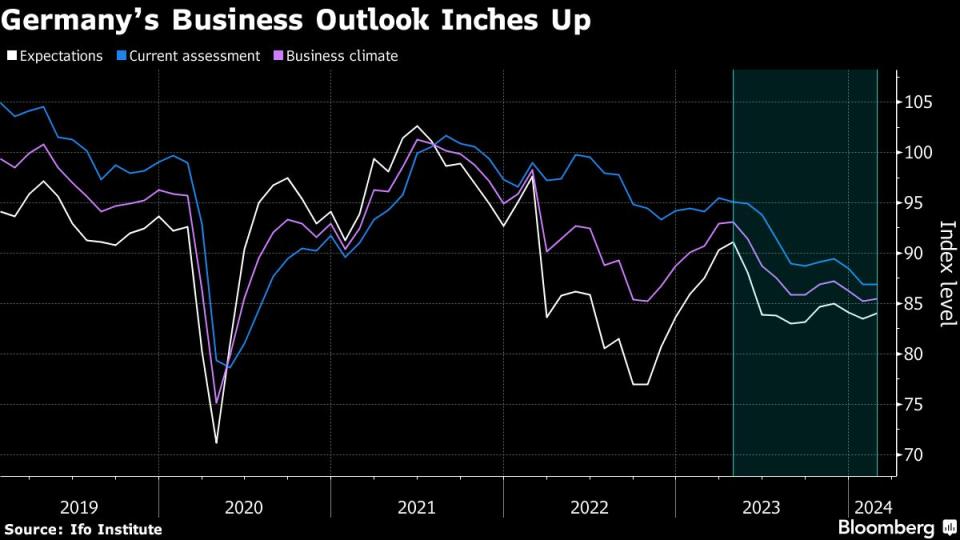

(Bloomberg) -- German business expectations edged higher though remained stuck at depressed levels amid a bleak outlook for Europe’s largest economy.

Most Read from Bloomberg

Buffett Says ‘Eye-Popping’ Results Unlikely With Record Cash

Investors Flee Tumbling EV Upstarts Once Hailed as ‘Next Tesla’

Litquidity Salary Reports Help Bankers Measure Up Annual Raises

An expectations gauge by the ifo institute rose to 84.1 in February from 83.5 the previous month. Analysts had predicted a small advance to 84. An index of current conditions held steady.

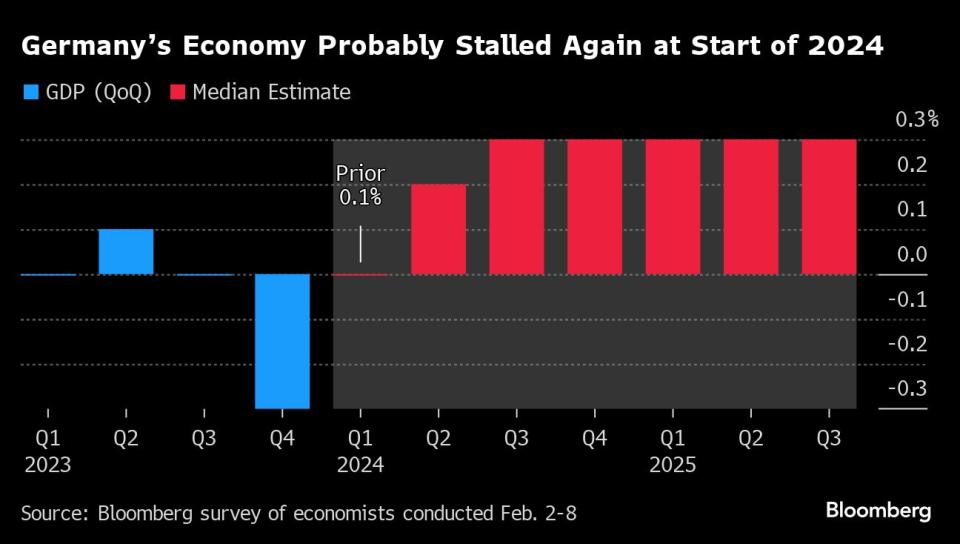

A separate release earlier Friday confirmed German output shrank by 0.3% in the fourth quarter, dragged down by a slump in investment that’s put the country on course for its first recession since the pandemic.

“It’s too early to say we are bottoming out,” ifo President Clemens Fuest told Bloomberg Television on Friday. “It’s a stabilization at a low level.”

The data highlight Germany’s protracted weakness — a performance that’s becoming an increasing concern for politicians in Berlin. The government this week slashed its growth forecast for 2024 to just 0.2%, following a 0.3% contraction over the whole of 2023.

The export-reliant economy has been suffering from weak foreign demand, high interest rates, the loss of Russian energy supplies and geopolitical tensions. Disagreements within Chancellor Olaf Scholz’s three-party coalition and a court ruling disrupting its spending plans have heightened uncertainty.

Manufacturing, on which Germany relies more than many other countries for growth, has been in a long downturn. A survey Thursday showed the retreat unexpectedly deepened in February as new orders plummeted both at home and abroad.

“We really see a further decline in manufacturing and production,” Fuest said. “Companies are telling us that orders are falling. It is the same in the production of investment goods. It is really domestic markets.”

Germany’s central bank reckons GDP may drop again in the first quarter, which would tip the country into a recession. Bundesbank President Joachim Nagel said Friday that stagnation may follow in the second quarter before a recovery begins.

That’s likely to feed the debate about Germany’s longer-term prospects, which are clouded by concerns over excessive bureaucracy, a quickly aging workforce and a lack of investment in infrastructure and crucial technologies.

“We need to do more to tackle the reforms in order to maintain Germany’s competitiveness in a completely changed environment,” Economy Minister Robert Habeck said Wednesday.

Rate cuts by the European Central Bank and some of its peers expected in the coming months may bring some relief. Pay increases for workers and slowing inflation are meanwhile seen stoking private consumption.

--With assistance from Kristian Siedenburg, Joel Rinneby, Angela Cullen and Alexey Anishchuk.

(Updates with comment from Bundesbank president in ninth paragraph.)

Most Read from Bloomberg Businessweek

Can the Masters of Hipster Cringe Conquer Hollywood With Wall Street Cash?

How Capital One’s $35 Billion Discover Merger Could Affect Consumers

Plug-In Hybrids Are Booming in the World’s Biggest EV Market

©2024 Bloomberg L.P.