Germany to Suspend Borrowing Limit Again After Budget Shock

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Germany will suspend a constitutional limit on net new borrowing for a fourth consecutive year after Chancellor Olaf Scholz’s government was forced into a radical budget overhaul by a ruling last week from the nation’s top court.

Most Read from Bloomberg

Everything You Need to Know About China’s Child Pneumonia Outbreak

‘Fear Gauge’ Hits 2020 Low as Stocks Up This Week: Markets Wrap

Xi Tolerance for Property Pain Nears Limit as Rescue Emerges

The emergency move to lift the so-called “debt brake” will be part of a revised 2023 budget that Finance Minister Christian Lindner plans to present next week, a spokeswoman for his ministry said Thursday. Because of the court judgment, Lindner has to retroactively account for at least €37 billion ($40.3 billion) of new off-budget debt earmarked to ease the burden of high electricity and gas prices on households and consumers.

It’s a humiliating climbdown for the chairman of the Free Democratic party, who insisted on the restoration of the borrowing limit after it was suspended for three years because of the pandemic and the energy crisis and sees himself as a guardian of Germany’s fiscal stability.

“With the supplementary budget, the federal government will propose a resolution to the Bundestag to establish an extraordinary emergency situation for 2023,” the spokeswoman said by email. The funds used to dampen energy costs will be “placed on a secure legal basis” and no new debt will be incurred, she added.

German debt extended declines after Bloomberg reported earlier Thursday that the government planned to lift the borrowing limit, pushing 10-year yields as much as six basis points higher to 2.62%. The premium on swaps over corresponding bonds — a key measure of supply risk — erased gains to leave the spread close to the lowest since February last year at 52 basis points.

Read More: German Yields Touch Session Highs on Debt Brake Suspension News

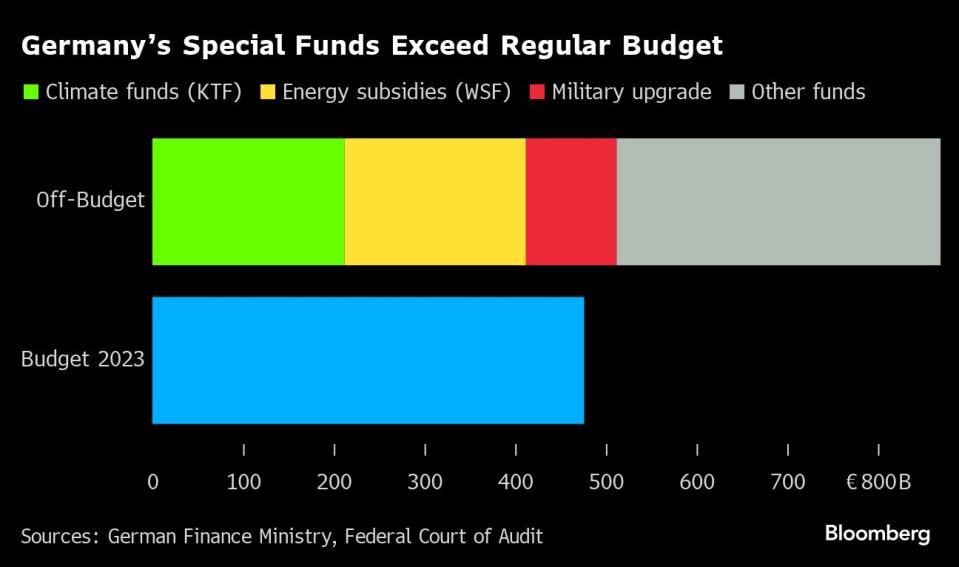

The bombshell Nov. 15 judgment by the Constitutional Court in Karlsruhe called into question hundreds of billions of euros of financing in the government’s special funds — some of them decades old — that are not part of the regular federal budget.

As well as dampening the impact of high energy costs, Scholz’s administration earmarked cash from the various pots for initiatives including greening manufacturing, expanding renewables and charging infrastructure and subsidies for battery and semiconductor facilities.

Using the special funds initially enabled Lindner to fulfill a pledge to reinstate the debt brake for the regular budget this year, while still directing cash to support the revamp of Germany’s manufacturing base and help reduce harmful emissions.

Suspending the debt brake again is the second major step the government is taking after it froze virtually all new spending authorizations for 2023 as it assesses the broader and longer-term impact of the court ruling.

It has yet to deal with the potential impact on next year’s finance plan, which was supposed to go to parliament next week but has now been delayed indefinitely. Any action it takes to overhaul the special funds also potentially opens it up to more legal challenges.

“We can only talk about 2024 and the next few years again once we have a legally secure, constitutionally sound situation,” Lindner said earlier Thursday in a brief statement to reporters. “There is now new legal clarity on how we have to deal with special assets.”

What Bloomberg Economics Says...

“The country’s fiscal policy outlook has become much more uncertain. A raft of infrastructure and environmental projects might not receive funding now. This could reduce GDP growth by 0.5 ppt next year, jeopardizing the gradual recovery after the downturn in 2023, and adding considerable downside risk to our 2024 forecast.”

—Martin Ademmer, economist. Click here for full GERMANY INSIGHT

Lars Klingbeil, a co-leader of Scholz’s SPD party, was quoted as saying Thursday that it’s “politically justified” to suspend the debt brake for this year and called for it to be lifted next year too.

In an interview with Handelsblatt newspaper, he said the “aftermath of the pandemic,” the energy crisis, inflation, the war in Ukraine and the situation in the Middle East make it necessary.

The borrowing restrictions are baked into Germany’s constitution but can be temporarily set aside in the case of natural disasters or emergencies beyond the control of the government.

They were suspended for three years through 2022 to address the fallout from the Covid-19 pandemic and the surge in energy costs triggered by Russia’s invasion of Ukraine.

Under the debt brake rules, structural net borrowing — adjusted to take cyclical factors into account — is limited to 0.35% of gross domestic product. An increase in net borrowing is permitted during an economic downturn, but there is less leeway for additional debt during an upswing.

--With assistance from James Hirai.

(Updates with finance ministry comment starting in second paragraph)

Most Read from Bloomberg Businessweek

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

Guatemalan Town Invests Remittance Dollars to Deter Migration

More Americans on Ozempic Means Smaller Plates at Thanksgiving

©2023 Bloomberg L.P.