Getting In Cheap On Booz Allen Hamilton Holding Corporation (NYSE:BAH) Is Unlikely

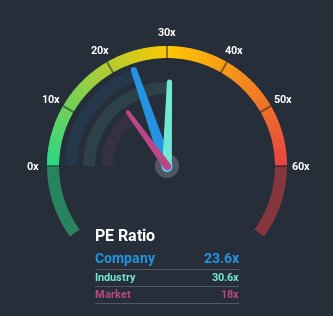

Booz Allen Hamilton Holding Corporation's (NYSE:BAH) price-to-earnings (or "P/E") ratio of 23.6x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Booz Allen Hamilton Holding has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Booz Allen Hamilton Holding

Keen to find out how analysts think Booz Allen Hamilton Holding's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Growth For Booz Allen Hamilton Holding?

The only time you'd be truly comfortable seeing a P/E as high as Booz Allen Hamilton Holding's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. The strong recent performance means it was also able to grow EPS by 107% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 7.1% each year over the next three years. With the market predicted to deliver 12% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's alarming that Booz Allen Hamilton Holding's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Booz Allen Hamilton Holding's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Booz Allen Hamilton Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Booz Allen Hamilton Holding that you need to take into consideration.

You might be able to find a better investment than Booz Allen Hamilton Holding. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.