Ghana Sees Debt Deal to Unlock IMF’s $600 Million in Coming Week

(Bloomberg) -- Ghana expects to reach a debt-relief deal in the coming week from its official creditors to qualify for further disbursements under a $3 billion International Monetary Fund loan program, Finance Minister Ken Ofori-Atta said.

Most Read from Bloomberg

Hamas Chief Who Deceived Israel Is Target No. 1 Deep Underground

Biden, Xi Declare Progress After Concluding Four-Hour Summit

Xi Says China Seeks to Be Friends With US, Won’t Fight ‘Hot War’

Israel Latest: Biden Defends Hospital Raid, Says Hamas Unbowed

“An agreement in principle on the restructuring parameters is expected to be reached in the coming week,” Ofori-Atta told lawmakers in his annual budget speech on Wednesday in the capital, Accra. “We expect the official creditor committee to come up with a memorandum of understanding which will ensure that this body co-chaired by France and China will deliver the appropriate MOU to the IMF.”

Ghana’s dollar bonds maturing in 2049 fell 0.4 cents to 41.18 cents on the dollar by 3:25 p.m. in London. Its 2032 securities were little changed at 41.18 cents.

The IMF reached a staff-level deal last month with Ghana on the first review of the program that started in May. The Washington-based lender pegged a further disbursement of $600 million on the West African nation getting bilateral creditors to agree on specific terms of debt treatment, in line with the financing assurances they provided several months ago.

Ghana is restructuring almost all of its $50 billion of debt to make it sustainable under the IMF program. The government has successfully completed a rework of its domestic loans. The next step is to revamp about $13 billion in eurobonds.

Talks with eurobond holders are continuing and the authorities are reviewing “illustrative proposals” on debt-treatment scenarios from two bondholder groups, Ofori-Atta said.

“It is envisaged that, in the coming weeks, extensive negotiations with both groups will commence and ensure we achieve the targets set under the IMF/World Bank Debt Sustainability Framework,” he said. “We are hopeful of a year-end resolution.”

Debt-Service Savings

This month, Fitch Ratings upgraded Ghana’s local-currency credit score from restricted default after the government completed a domestic restructuring that resulted in “sizable” debt-servicing savings.

Ofori-Atta’s budget steered clear of measures that might have been popular with voters as the country heads into an election next year. That reflects Ghana’s need to restore investor confidence and abide by the conditions of its deal with the IMF.

The finance minister outlined plans to boost economic growth, lower inflation and improve key budget metrics next year, as strict measures imposed under the IMF deal bear fruit.

He forecast economic growth of at least 2.8% next year and by 5% in 2027, compared with 2.3% in 2023. Central bank policies aimed at curbing price pressures are likely to help rein in inflation to 15% by the end of 2024. The rate was 35.2% in October.

“Ghana has turned the corner and is getting back on track,” Ofori-Atta said. Ghana is “determined to maintain the discipline, compassion and creativity required to keep the economy stable,” he said.

Other Budget Highlights:

Gross domestic product in 2024 is forecast to cross the 1 trillion-cedi mark for the first time in the nation’s economic history

Non-oil real GDP growth of at least 2.1% is expected

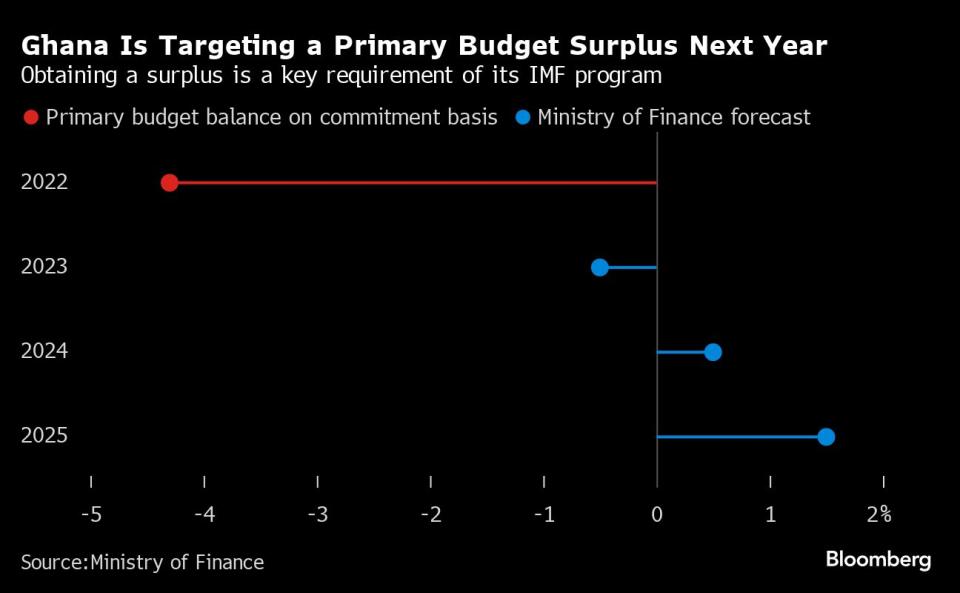

A primary balance surplus on a commitment basis of 0.5% is projected for next year

Forex reserves to cover not less than three months of imports are forecast for 2024

Environmental excise duty to be expanded to cover plastic packaging, and industrial and vehicle emissions

Government will review the tax-free portion of individual income tax rates

Plans to waive import duties on electric vehicles for public transportation for a period of eight years

A value-added tax flat rate of 5% to replace the 15% standard rate on all commercial properties

Most Read from Bloomberg Businessweek

Sequoia Icon Michael Moritz Bets $300 Million on Reshaping San Francisco

At REI, a Progressive Company Warns That Unionization Is Bad for Vibes

Peter Thiel Is Still Hoping That Donald Trump Just Fades Away

©2023 Bloomberg L.P.