Glaukos (GKOS) Q4 Earnings and Revenues Surpass Estimates

Glaukos Corporation GKOS reported fourth-quarter 2020 loss per share of 2 cents, significantly narrower than the Zacks Consensus Estimate of a loss of 32 cents. Notably, the company had delivered a loss per share of 6 cents in the prior-year quarter.

For the full-year 2020, the company reported a loss of $1.15 per share, narrower than the Zacks Consensus Estimate of a loss of $1.41 per share. It had delivered loss per share of 10 cents in 2019.

Revenues in Detail

Quarterly net sales totaled $73.2 million, which surpassed the Zacks Consensus Estimate by 0.3%. On a year-over-year basis, revenues improved 11.2%.

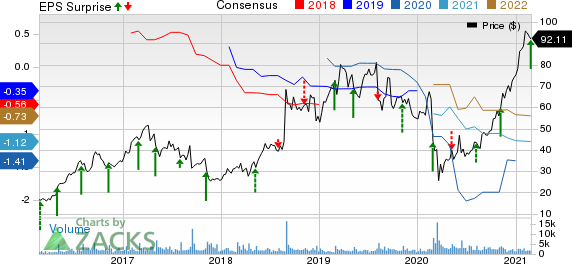

Glaukos Corporation Price, Consensus and EPS Surprise

Glaukos Corporation price-consensus-eps-surprise-chart | Glaukos Corporation Quote

For the full-year 2020, the company’s net sales amounted to $224.9 million, down 5.1% from the previous year. The figure beat the consensus mark by 0.1%.

Quarter Details

Gross profit in the fourth quarter was $53.6 million, up 7.4% year over year. Gross margin was 73.3% of net revenues, down 250 basis points (bps) on a year-over-year basis.

Operating expenses declined 18.3% to $65 million on a year-over-year basis, courtesy of lower selling, general and administrative expenses.

Operating loss in the quarter under review was $11.4 million, significantly narrower than the year-ago quarter’s loss of $29.7 million.

Financial Update

The company exited the fourth quarter with cash and cash equivalents of $96.6 million, up from $80.9 million on a sequential basis.

During the fourth quarter, total current assets totaled $469.4 million, compared with $454.4 million in the preceding quarter.

First Quarter 2021 Guidance

For first-quarter 2021, Glaukos projects net sales to grow around 15-20% on a year-over-year basis.

Our Take

Glaukos exited the fourth quarter on a strong note. The company also reported an improvement in revenues in the quarter under review. Further, advancement in its market-expanding pipeline and execution of quite a few business development growth initiatives that include the Avedro buyout buoys optimism. Also, its U.S. Glaucoma franchise saw a solid recovery during the quarter under review courtesy of practices boosting their operational efficiency and rise in new patient demand with the easing of prior restrictions.

However, the company faces cut-throat competition in the Medical Devices space. Glaukos witnessed a contraction in its gross margin in the quarter under review. Operating loss raises concern.

Zacks Rank

Glaukos has a Zacks Rank #4 (Sell).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks in the broader medical space that have already announced their quarterly results are Hologic, Inc. HOLX, Abbott Laboratories ABT and AngioDynamics, Inc. ANGO, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Hologic reported first-quarter fiscal 2021 adjusted EPS of $2.86, which surpassed the Zacks Consensus Estimate by 33.6%.

Abbott reported fourth-quarter 2020 adjusted EPS of $1.45, which beat the Zacks Consensus Estimate by 6.6%. Fourth-quarter worldwide sales of $10.7 billion outpaced the consensus mark by 7.9%.

AngioDynamics reported second-quarter fiscal 2021 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss per share of 2 cents. Revenues of $72.8 million beat the consensus mark by 8%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research