Global Warming Is Already Costing the Insurance Industry Historic Amounts

Climate change is becoming increasingly costly, according to a new study from Swiss Re, a reinsurance company based out of Switzerland. The combined insured natural catastrophe losses for the two year period between 2017-2018 was $219 billion, the highest ever over a two-year period. The company credits man-made activities like urbanization and climate change with the higher price tag.

The world's second-largest reinsurer, Swiss Re insures insurance companies around the world with offices in 25 countries. Through regular reports released under the name sigma, the company offers a lens into the changing trends of the insurance world.

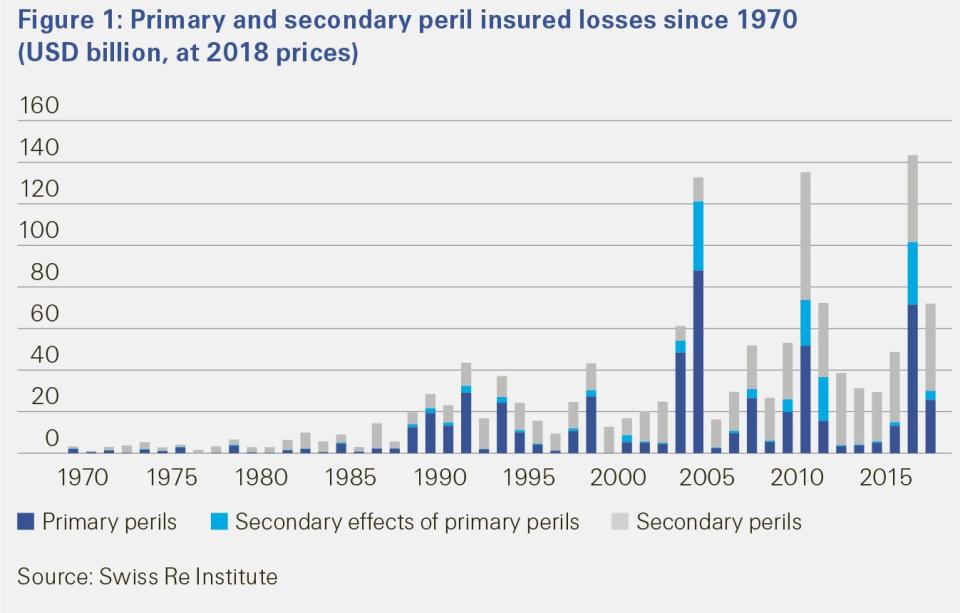

The report highlights what the insurance industry calls "secondary perils," of which there are two divisions- small-to-mid-sized events (like river floods or wildfire otubreaks), and secondary effects of major disasters (like hurricane-induced precipitation, or fires following an earthquake). According to Swiss Re, secondary perils don't get the attention they should from the insurance industry.

“Large losses from secondary perils are occurring more regularly”, says Edouard Schmid, Swiss Re’s Group Chief Underwriting Officer in a press statement. “This is a trend the insurance industry must act on so that we can continue to underwrite catastrophe business sustainably.”

One problem is that secondary events are simply becoming larger. The single largest insurance event of 2018 was California's Camp Fire, a destructive blaze which killed 85, burned 153,336 acres, and cost insurance companies $12 billion (the full cost of the damage was $16 billion).

Another prime example of a secondary peril's cost was Hurricane Florence, which killed at least 41 as it slowly moved through the Carolinas. While the hurricane was a primary peril, the flooding it caused was a secondary peril. That flooding ended up costing approximately $28.5 billion for insurers, not counting the $18.5 billion worth of damage that was uninsured.

Both of these disasters were strengthened through climate change. The Camp Fire was helped by vegetation drying, Florence's storm surge rose with sea levels. For the insurance industry, Swiss Re this should be a wake up call that man-made climate change's effects will be long-lasting. "Losses from secondary perils have been rising due to rapid development in areas exposed to severe weather and warmer temperatures," the company says in sigma, "and we expect this trend to continue."

There are a number of ways that insurers could face the situation, Swiss Re says. They could leverage new technology, calling for a more regulated environment, and focus on insuring sustainable building projects. "Global re/insurance assets amount to approximately $30 trillion," the company says in sigma. "Even a small part of this could unlock a significant amount of capital for deployment into long-term resilience-building infrastructure projects."

('You Might Also Like',)