Is Goal Forward Holdings (HKG:1854) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Goal Forward Holdings Limited (HKG:1854) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Goal Forward Holdings

What Is Goal Forward Holdings's Debt?

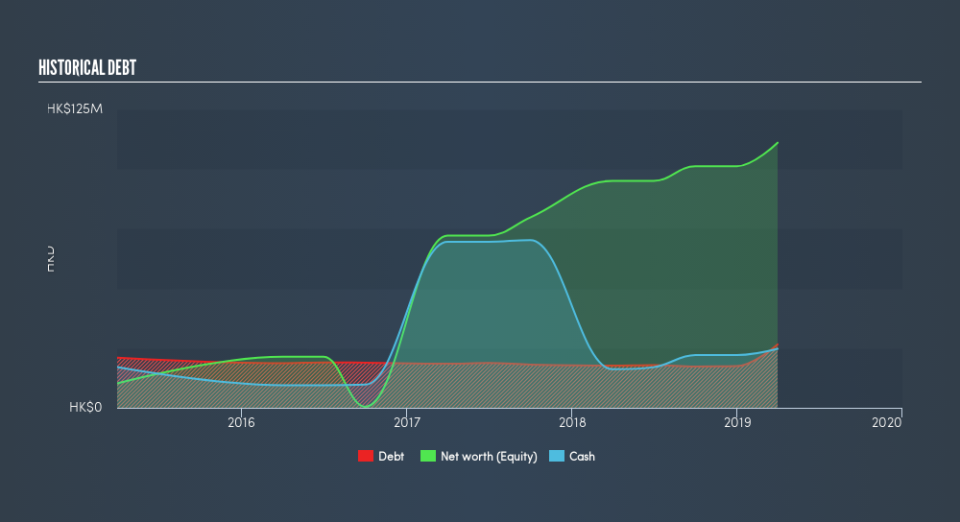

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Goal Forward Holdings had HK$26.7m of debt, an increase on HK$17.9m, over one year. However, because it has a cash reserve of HK$24.7m, its net debt is less, at about HK$1.95m.

How Healthy Is Goal Forward Holdings's Balance Sheet?

According to the last reported balance sheet, Goal Forward Holdings had liabilities of HK$38.4m due within 12 months, and liabilities of HK$1.26m due beyond 12 months. On the other hand, it had cash of HK$24.7m and HK$37.7m worth of receivables due within a year. So it can boast HK$22.7m more liquid assets than total liabilities.

This short term liquidity is a sign that Goal Forward Holdings could probably pay off its debt with ease, as its balance sheet is far from stretched. But either way, Goal Forward Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With debt at a measly 0.07 times EBITDA and EBIT covering interest a whopping 49.9 times, it's clear that Goal Forward Holdings is not a desperate borrower. So relative to past earnings, the debt load seems trivial. But the other side of the story is that Goal Forward Holdings saw its EBIT decline by 8.5% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But it is Goal Forward Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Goal Forward Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Goal Forward Holdings's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better There's no doubt that its ability to cover its interest expense with its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Goal Forward Holdings's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Goal Forward Holdings's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.