Gold Forecast – Soaring Inflation and a Collapsing Dollar to Fuel Gold’s Next Big Advance

Companies were unable to fill entry-level positions as they compete with Federal unemployment benefits. Not working apparently still pays better than working for some Americans.

Companies continue to cite higher input costs and inflationary worries across all sectors of the economy. The next round of CPI (consumer price index) numbers comes out Wednesday.

SPIKING INFLATION

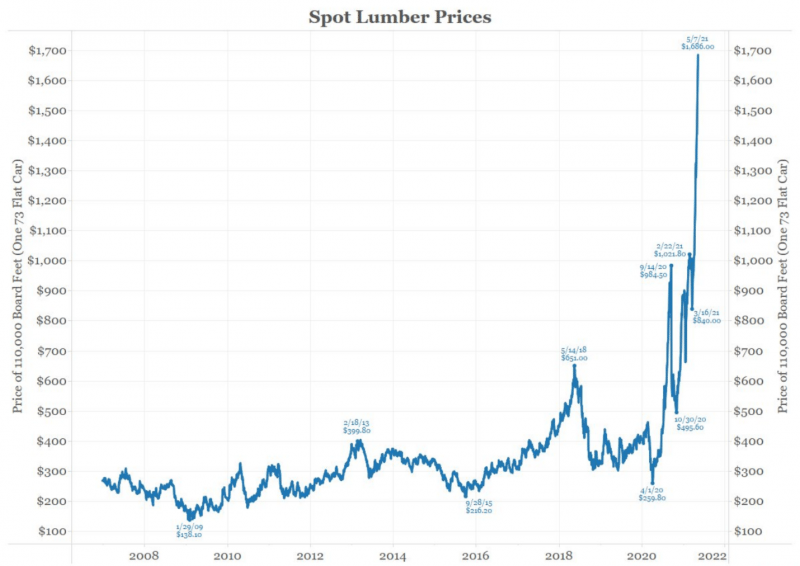

Note below the parabolic rise in lumber prices. Lumber per 110,000 board feet has rocketed from $259.80 in 2020 to $1,686.00. This is adding tremendous pressure to residential construction expenses.

BIDDING WARS

Higher building costs, low housing inventory, and record low interest rates have created a perfect storm for skyrocketing housing prices. In some areas, housing has jumped 15% to 20% during the pandemic. I hear stories of bidding wars and prospective buyers offering anywhere from $50,000 to $100,000 over the asking price to secure a property.

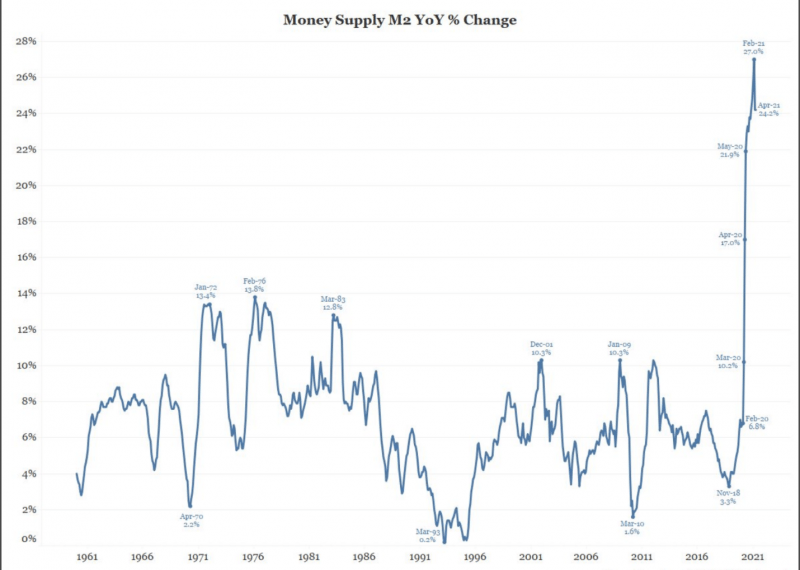

Feeding these absurd price increases is unprecedented money printing. Below is a chart of the year-over-year change in the M2 money supply. In February 2021, it hit a record 27%.

In my opinion, the inflation genie is out of the bottle, and there is little the Fed can do to stop it. As companies increase prices, consumers will become conditioned. Eventually, the psychological aspect of higher inflation and a collapsing dollar will prompt individuals to buy items today for fear of higher prices later. This is something we have not seen since the 1970s.

RAMPANT SPECULATION

Eventually, the speculation we currently see in cryptocurrencies will move to precious metals (hard assets). Last week, Dogecoin exceeded the market cap of General Motors. Unbelievable!

Dogecoin was literally created as a joke in 2013 – it has ZERO use but speculation. A few days ago, while I was getting an oil change, I overheard employees speculating how they were about to get rich off Dogecoin and how they would instantly quit their jobs. These are the types of conversations you overhear near a top.

Historically speaking, precious metals are hands-down the best long-term inflation hedge, especially silver.

TECHNICAL OUTLOK

US DOLLAR

After a brief bounce, the dollar reversed lower after testing the 50-day EMA. Prices closed below the short-term trendline, and we could be on the verge of a major breakdown. Dropping below the January low (89.17) could trigger a collapse back to the 80 levels by August.

GOLD

Gold broke decisively above the $1800 level, and prices are poised for a sharp advance as the dollar collapses to fresh lows. Initially, we expected a retest of the $2000 level, but prices could surge to new highs if the dollar slips to 80 as forecasted. The 40-day cycle bottomed precisely with our outlook.

SILVER

Silver Prices are rising slowly out of the 8-month cup-with-handle formation. I’d like to see the uptrend begin to accelerate over the coming weeks and mount another assault on the $30.00 price level. Ultimately, I’m looking for a breakout above $30.00 and a run to multi-year highs before the next intermediate cycle peaks sometime in August.

Expect increased volatility as we determine the fallout over the recent cyberattack on the U.S. oil pipeline.

A much higher than expected CPI number could light a fire under precious metals.

AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more information, please visit here.

This article was originally posted on FX Empire