Gold and Metals on Correction Mode Ahead FOMC Meeting

Gold is trading negative as well as other precious metals such as silver, copper, and platinum as investors are waiting for the Federal Reserve 2-day meeting that will start on Tuesday.

Traders are wondering what the FOMC will suggest with its economic outlook between cutting or not interest rates. The dollar index is trading sideways at 97.50, adding pressure to metals.

Metals investing report for June 17

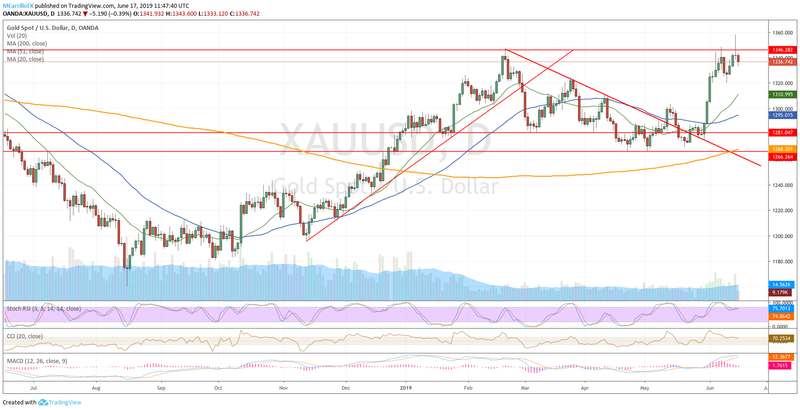

Gold is extending its rejection from 1,358.20, highs since April 11, 2018, as the unit is opening the week with a 0.60% decline to 1,334.20.

Silver is trading negative for the second day, and after rejecting the 15.10 level on Friday, it is going down on Monday to test the 50-day moving average at 14.80.

Copper is down on Monday as the pair is extending its decline for the second day. It is now testing the 2.6000 area; the unit remains subdued by the 20-day moving average, currently at 2.6560.

Palladium is trading in consolidation mode around 1,462 as the XPD/USD is performing its first negative day in the last eight. The unit is testing April 28 and 29 highs at 1,465.

Platinum accelerated its decline from 820 as it is falling for the second trading day and it is now testing the 790.00 area, May 30 lows. Below there, platinum will face a double bottom level at the critical support at 780.00.

All eyes on FOMC meeting

The market is focusing on the FOMC meeting that will take place on Tuesday and Wednesday this week. Will it be a rate cut or not? That’s the question.

However, it is not the only thing traders will pay attention to. Even if there is not a rate cut, changes in the statement and economic assessment, dots chart and possible remarks from policymakers will point FOMC directions regarding rate cuts, and it will move the market.

Besides the Fed, the Bank of Japan and the bank of England are scheduled to have monetary policy meetings, and they will have their say on currencies fluctuations including the US Dollar, therefore, metals such gold.

Gold extends rejection from 14-month lows

Gold is trading negative on Monday as the metal is performing a correction after reaching highs since April 2018 at 1,358.

XAU/USD is currently trading 0.45% negative on Monday as it is trading at 1,335. The decline stopped for now, but it could extend drop to 1,330 where the first support waits.

However, the trend remains positive, and Monday’s move seems to be a correction. So, gold would see 1,345 level as the next resistance and then current highs at 1,358. Above there, 1,365 is an important double top performed on January and April 2018.

This article was originally posted on FX Empire