Goldman Sachs eyes a $100B 'revenue pool' in China by mid-2020s

Goldman Sachs sees "a very significant future potential" for growth in China.

During the firm's inaugural Investor Day on Wednesday, the firm laid out an expansive view of its future, which includes redoubling its efforts on consumer and digital banking.

Yet Goldman also promoted what it called “immense opportunities in a shifting landscape" in the world’s second largest economy, said Goldman Sachs International CEO Richard Gnodde, even as China grapples with a destabilizing virus outbreak that’s upending businesses and markets.

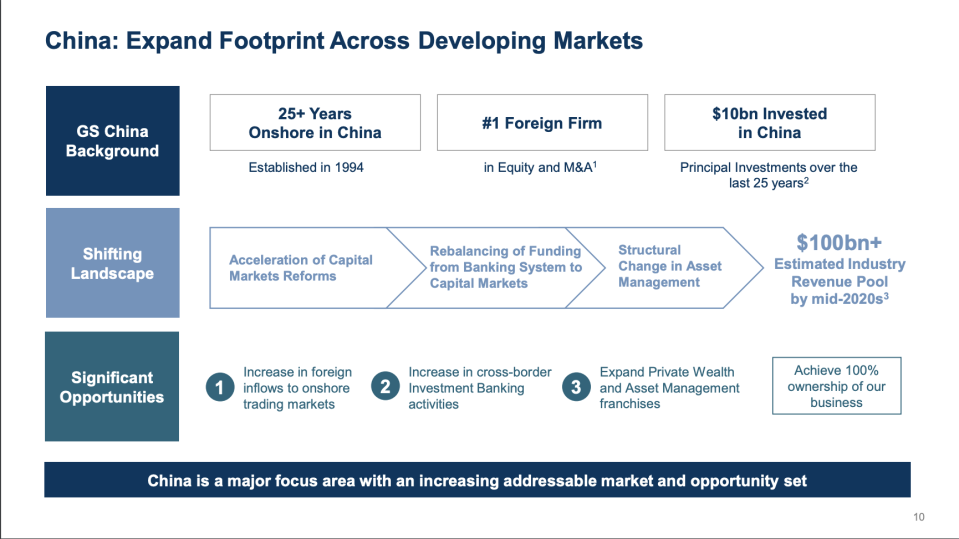

As China opens up its financial industry, Goldman Sachs estimates that by the mid-2020s there will be "a revenue pool in excess of $100 billion across our portfolio of businesses.” According to Gnodde, Goldman is “...well-positioned to participate in this growth across all of our businesses."

Goldman Sachs, which has operated onshore in China for more than 25 years, is ranked the No. 1 foreign bank for M&A and equity underwriting. The bank has invested $10 billion in China during that time and driven $15 billion in value creation, Gnodde added.

Currently, however, the country is reeling from a coronavirus outbreak that’s sparked growing fears of a global pandemic. On Friday, Goldman’s economics team predicted the epidemic would shave at least 1/4 of a percentage point from China’s growth this year.

Still, John Waldron, Goldman's president and chief operating officer, said on Wednesday that the country remains"strategically important for the long term."

Some of the opportunities include an increase in foreign inflows to onshore trading markets, expanding private wealth and asset management franchises, and increasing cross-border investment banking activities.

"As we see the Chinese government increasingly taking actions that appear to be accelerating the opening up of markets, we will be patient and deliberate here...but the scope of this opportunity remains very attractive for Goldman Sachs," Waldron said.

Waldron added that the firm is applying for 100% ownership of its business in China, which is "a key part of our 5-year plan."

"This will enable us to better manage our operations onshore, while investing for growth across every part of our business, with a particular focus on building asset management and private wealth platforms over time as this landscape continues to evolve,” the executive said.

“And we are confident in our ability to execute upon our growth plan, based on our strong track record building businesses organically over time," Waldron added.

Gnodde noted that the firm has "sought to partner with China's leadership from a policy perspective, providing thought leadership as they seek to build a financial system that's fit-for-purpose and can help fund the enormous growth that, that economy is enjoying."

A joint venture established in 2004 was structured in a way that gave Goldman "effective management control,” and positions the firm for the future, Gnodde said.

"And so when we secure a 100% ownership, we will have a team that's already fully integrated, up and running, and that should give us an advantage, and a head-start over many of our competitors,” he added.

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.