'You got to pay the bills': County commission adopts 16% property tax hike

Rutherford County property taxes will increase nearly 16.1% for public services in the next fiscal year, officials decided Monday.

The Rutherford County Commission voted 13-8 in support of the tax hike recommended by Mayor Joe Carr to help fund an $849.8 million budget for government and education services. The owner of a home appraised at $334,600, the median value out of 92,036 houses by the Rutherford County Property Assessor's Office, will pay over $217 more in annual property taxes with a new total payment of more than $1,569.

"We're here to do a job," Commissioner Anthony Johnson said after joining the majority in supporting the tax increase for a fiscal year that starts July 1. "You got to pay the bills."

Commissioners Hope Oliver and Steve Pearcy took issue with Johnson's suggestion after both voted against the tax hike.

"We did our job," said Oliver, adding the tax hike would not be what's "best for our constituents."

Pearcy agreed.

"I represented the people in my district who asked me not to raise their property taxes, and I think I've done my job," Pearcy said.

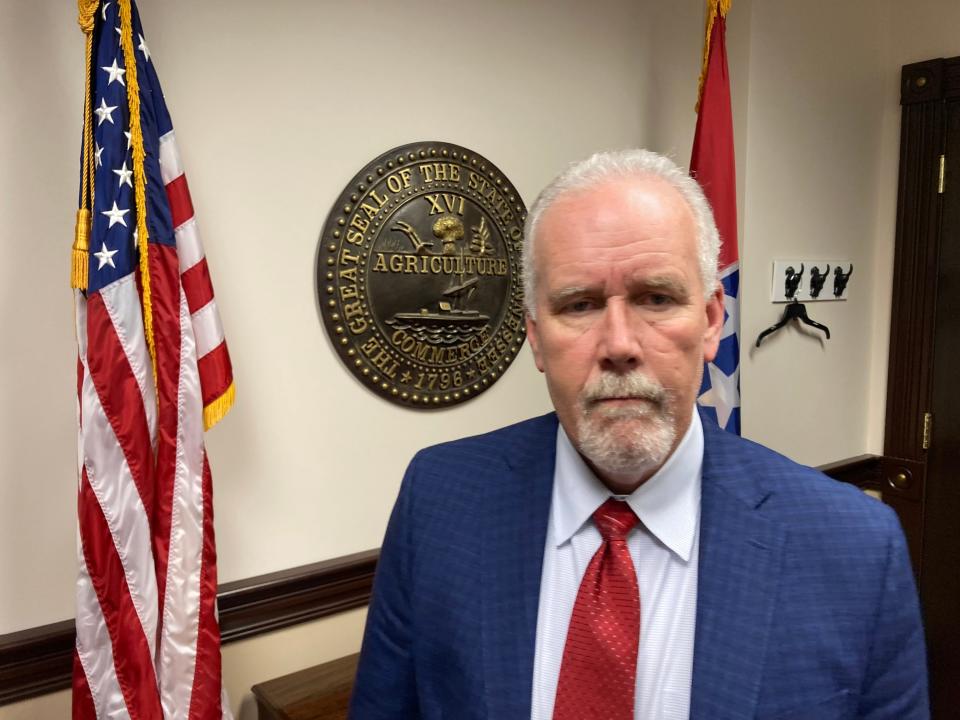

County Mayor Joe Carr proposes 16% hike: 'All tax increases are significant. I hate it'

Commission reduces previous $64 million deficit

Mayor Carr praised all of the commissioners for voting on their values and principles.

Carr had recommended the tax increase following a previous year when the commission approved a budget with a $64 million deficit and used rainy day reserves to help pay for operations, including raises up to nearly 20% for public safety workers.

Next year's budget has a $7.5 million deficit after the mayor said he worked with department heads to cut $25 million from their initial budget requests.

The tax increase helps rebuild reserves that are needed for emergencies, such as overtime costs to respond to the tornado that damaged the Readyville community east of Murfreesboro. Ample reserves also help the county maintain a Moody's AAA bond rating to borrow money for school projects in particular at lower interest rates, Carr said.

The county, for example, will be using bond money on $156.3 million to pay for the expansions and renovations of overcrowded Riverdale, Smyrna and Oakland high schools.

'Significant' property tax hike coming: Mayor Carr seeks solution for $64 million deficit

The future goal for county officials will be to find alternative revenues to help pay for school building projects, so "the property taxpayers are not continuously burdened with paying for growth," said Carr, a first-year mayor who replaced former Mayor Bill Ketron. Carr won his seat in August after winning the Republican primary May 2022.

"This property tax increase is a direct result of the years and years of this county not being able to pay for the growth, primarily the residential growth, as a result of so many people wanting to come and live here," Carr said.

Paying for the growth needs of schools, law enforcement, fire protection and Emergency Medical Services "unfortunately, unlike other counties and other cities, is borne by the property taxpayer of Rutherford County," Carr said.

Tax and growth issues: 7 TN lawmakers annoy Mayor Carr with letter saying his proposed property tax hike unneeded

Mayor appeals to lawmakers to allow alternative taxes for growth

The mayor said it saddens him for the county to raise property taxes.

"But it's necessary," Carr said. "In as much as I am very fiscally conservative and I despise raising taxes, what I despise more is being fiscally irresponsible."

The mayor said he hopes the Tennessee General Assembly will allow the county to pursue alternative taxes to help fund growth needs in future years to avoid relying on property tax hikes.

"We have to pay our bills," Carr said. "We have to pay our bond debt. And we have to maintain our triple-A bond rating. In order for us to do those three things, we had to raise property taxes. And I hate it."

Prior to the vote, commissioners heard a speech from Susan Allen, a leader with the Rutherford Neighborhood Alliance, urging them to keep pursuing other revenues such as impact fees on development to help pay for plans to provide for the needs of growth.

"There are alternative ways to approach growth," Allen said during the public comments part of the meeting.

Paying for growth: Rutherford County officials want state law to stop 'burden of paying for new development'

Property Assessor Rob Mitchell speaks against tax hike

The commissioners also heard Rutherford County Property Assessor Rob Mitchell speak against the property tax increase during the public comments portion of the meeting.

"I oppose this tax hike because I believe it offers a superficial solution that fails to address the root causes of our financial challenges," Mitchell said.

The crux of the issue lies in how our county functions, said Mitchell, a Republican who plans to run for another four-year term in 2024.

"We can no longer turn a blind eye to the waste of our hard-earned resources," Mitchell said. "It is time to confront this matter head-on and begin the necessary changes. We must meticulously scrutinize every dollar, identify and eliminate duplication of services, and streamline operations to restore fiscal prudence."

The property assessor urged the commissioners to seek another solution than raising property taxes.

"It may be politically painful, but it is not a hard task to spend someone else's money," Mitchell said. "The money we spend is someone's mother's formula for her infant. It is someone's elderly person's prescriptions."

'Absolutely ridiculous': Residents voice concerns on proposed 16.2% property tax hike

After the meeting, Commissioner Joshua James said he opposed the tax hike to fund spending because he wants county officials to pursue a deeper look at appropriations with long-term vision.

"We need to facilitate our budgets with long-term planning," James said. "This county has nearsighted vision."

Reach reporter Scott Broden with news tips or questions by emailing him at sbroden@dnj.com. Follow him on Twitter @ScottBroden. To support his work with The Daily News Journal, sign up for a digital subscription for all dnj.com stories.

Roll call: Commission backs tax hike in 13-8 vote

Rutherford County Commission members who voted for the nearly 16.1% property tax increase: Robert Peay Jr., Laura Davidson, Jonathan Beverly, Mike Kusch, Pettus Read, Phil Wilson, Anthony Johnson, Carl Boyd, Craig Harris, Phil Dodd, Jeff Phillips, Romel McMurry and Chantho Sourinho

Commissioners who opposed tax hike: Hope Oliver, Steve Pearcy, Michael Wrather, Joshua James, Paul Johnson, Wayne Irvin, Allen McAdoo and Trey Gooch

Note: Seven of eight commissioners opposing tax hike also voted against the approved $849.8 million budget to fund government and education services. Wrather, unlike his opposition to the tax hike, joined the majority in 14-7 vote to approve the appropriation.

Source: Rutherford County Commission meeting on June 26 at the Rutherford County Courthouse

This article originally appeared on Murfreesboro Daily News Journal: Rutherford County Commission approves 16% tax hike