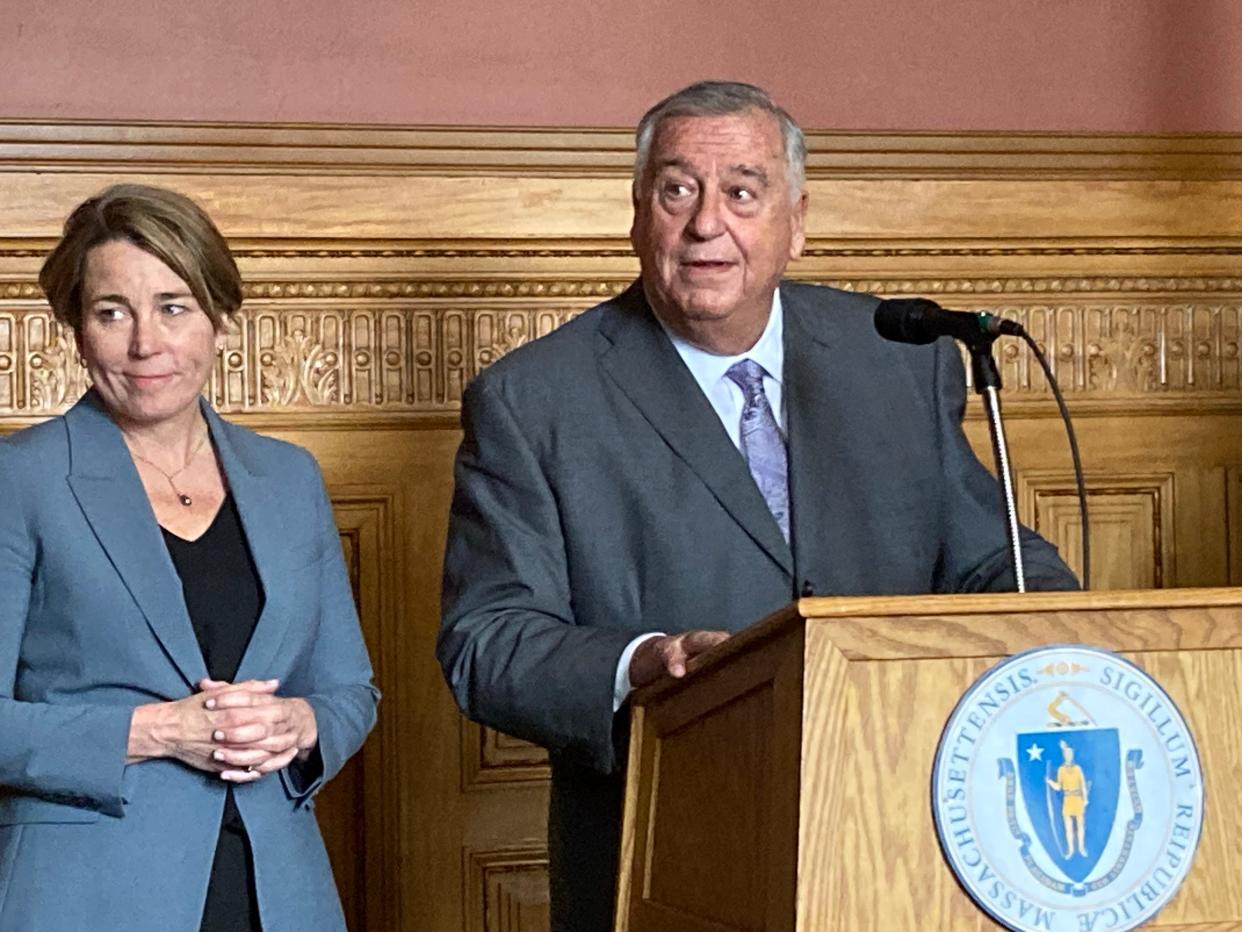

Gov. Healey's budget promises to maintain, increase spending levels across the board

BOSTON — In presenting her fiscal 2024 budget, Massachusetts Gov. Maura T. Healey promised to maintain and increase state spending levels for all departments and programs.

The freshman governor has proposed increasing local aid to municipalities, fully funding the Student Opportunity Act and increasing state investments in clean energy and environmental goals.

In total, the $55 billion budget plan would be a 4.1% increase over the budget for the current fiscal year.

Healey's budget includes new funding for education and transportation using revenue generated by the so-called "millionaire tax" passed by voters in November. The new law increases personal income taxes on residents earning more than $1 million a year from 5% to 9% on every dollar earned over the first million.

Experts estimated the tax would generate between $1 billion and $3 billion a year. In her budget, Healey earmarked $510 million of the new revenue for education and $490 million for transportation. The bulk of education funds, $360 million, will be allocated to higher education initiatives such as expanding financial aid, stabilizing tuition and fees and new capital funding.

MassReconnect, Healey's program to make community college tuition-free for Massachusetts residents over age 25 who have not already earned a degree, would get $20 million in funding.

Healey's budget would also freeze tuition for incoming freshmen for four years at the state's public colleges and universities. The program would only be open to in-state students. The administration has yet to determine whether it would also extend the freeze to students already attending school or to upperclassmen who transfer into the state system.

The budget earmarks $140 million for early childhood education and care including $100 million to child care providers that provide subsidies for low-income families needing care; and $25 million to chip away at the waiting list of 20,000 families seeking subsidized child care.

The Healey budget would send $100 million from the "millionaire tax" to a municipal partnership program that would assist communities in planning transportation projects.

Also on the transportation side: $100 million for highway bridge preservation and $14 million for roadside maintenance and beautification projects. The Massachusetts Bay Transportation Authority stands to benefit by $186 million, in addition to the funding already allocated through the transfer of state sales tax money. The MBTA was allocated additional funding twice by the legislature last year: $266 million and $112 million.

Healey allocated $25 million to regional systems, $12.5 million for the Palmer and Pittsfield rail projects and $2.5 million to support water transportation.

The Healey administration expects to create an ancillary budget as well as creating a trust fund, to capture all revenues produced by the new tax on high earners. The first priority of the trust fund is to build a base using a third of the revenue. That base could not be spent and only accessed to maintain funded programs in the event the expected revenue drops.

For housing and homelessness: The Healey Administration proposes adding 750 new vouchers to 10,000 existing Massachusetts Rental Voucher Program vouchers and 150 new vouchers to the Alternative Housing Voucher Program used by residents with disabilities.

The Emergency Assistance Family Shelter program was allocated $324 million for 4,700 shelter units for vulnerable families; $163 million for families in transition (Residential Assistance for Families in Transition) and $111 million for individuals in homeless shelters; this amount preserves more than 2,600 permanent shelter beds. Other initiatives include $42 million for HomeBASE, which connects eligible families to permanent housing.

Climate and energy initiatives include money for food security infrastructure grants: $25 million and $35 million for the Massachusetts Clean Energy Center.

In the body of the budget Healey devotes millions to "developing the state's capacity for high quality child care": $475 million to Commonwealth Cares for Children grants to providers. The funds support providers with basic costs including raising workers' salaries. There's also $30 million for the Commonwealth Preschool Partnership Incentive designed to increase enrollment in pre-Kindergarten programs in the state's Gateway Cities.

The budget includes funds to build bed capacity for residents, including children, suffering from mental health ailments: $37 million for community providers and emergency departments, $60 million for behavioral health initiatives to expand in-patient and community capacity as well as $500,000 for mental health services provided by the Department of Children and Families' case review teams. Day centers are slated to receive $100 million.

In a separate line item not related to the Fair Share funding, the state Department of Transportation was allocated $529 million for operations which includes highway, Registry of Motor Vehicles, rail, transit and aeronautics (airports) operations.

This article originally appeared on Telegram & Gazette: Budget grows by 4.1% over 2023; includes new funds for ed & transit