Government accuses Boise’s Norco, ex-CEO of overvaluing stock sold to employees

The U.S. Department of Labor is suing Norco, its former CEO James Kissler, the company’s employee stock ownership plan and Alerus Financial NA, saying they overvalued stocks sold to an employee retirement plan several years ago.

Norco, incorporated in Boise in 1967, sells medical supplies and welding, safety and industrial equipment and gases. It has 70 stores around the Northwest.

Kissler sold most of his shares in the company in 2015 to form a new retirement plan established for employees, the Idaho Statesman previously reported. He hired Alerus Financial NA, a North-Dakota-based financial services firm, to act as the plan’s trustee and independent fiduciary for the transaction.

Chartwell Financial Advisory, a valuation advisor, conducted an appraisal of the company.

The lawsuit, filed Nov. 30 in the U.S. District Court in Boise, says Alerus authorized a deal to pay Kissler and a related family foundation more than $140 million for 35% of Norco’s stock without performing a “good faith investigation” into its fair market value.

“Alerus rushed its due diligence in order to close the transaction on the sellers’ preferred timetable, and in the process relied on a valuation report rife with manifest flaws that substantially overvalued the stock,” the lawsuit said. “Indeed, that report valued Norco at an amount nearly 250% greater than the value reached by a reputable valuation firm retained by Norco roughly three and a half years earlier.”

Federal law, specifically the Employee Retirement Income Security Act of 1974, requires fiduciaries to act prudently and pay no more than fair market value for the stock.

The lawsuit said the valuation report the transaction relied upon caused the employee stock and ownership plan to overpay by tens of millions of dollars. It said Kissler was closely involved in all aspects of the transaction and knew Alerus’s negotiation and investigation of the fair market value of the shares was flawed.

Kissler told the Statesman that he was not involved in the negotiations, nor was he aware of the valuations.

“I don’t feel I did anything wrong,” he said Friday night by phone. ”I wanted to share the wealth of the company’s growth with my employees, and the only way to do that, besides giving them good benefits and a good place to work, was to give them shares of stock.”

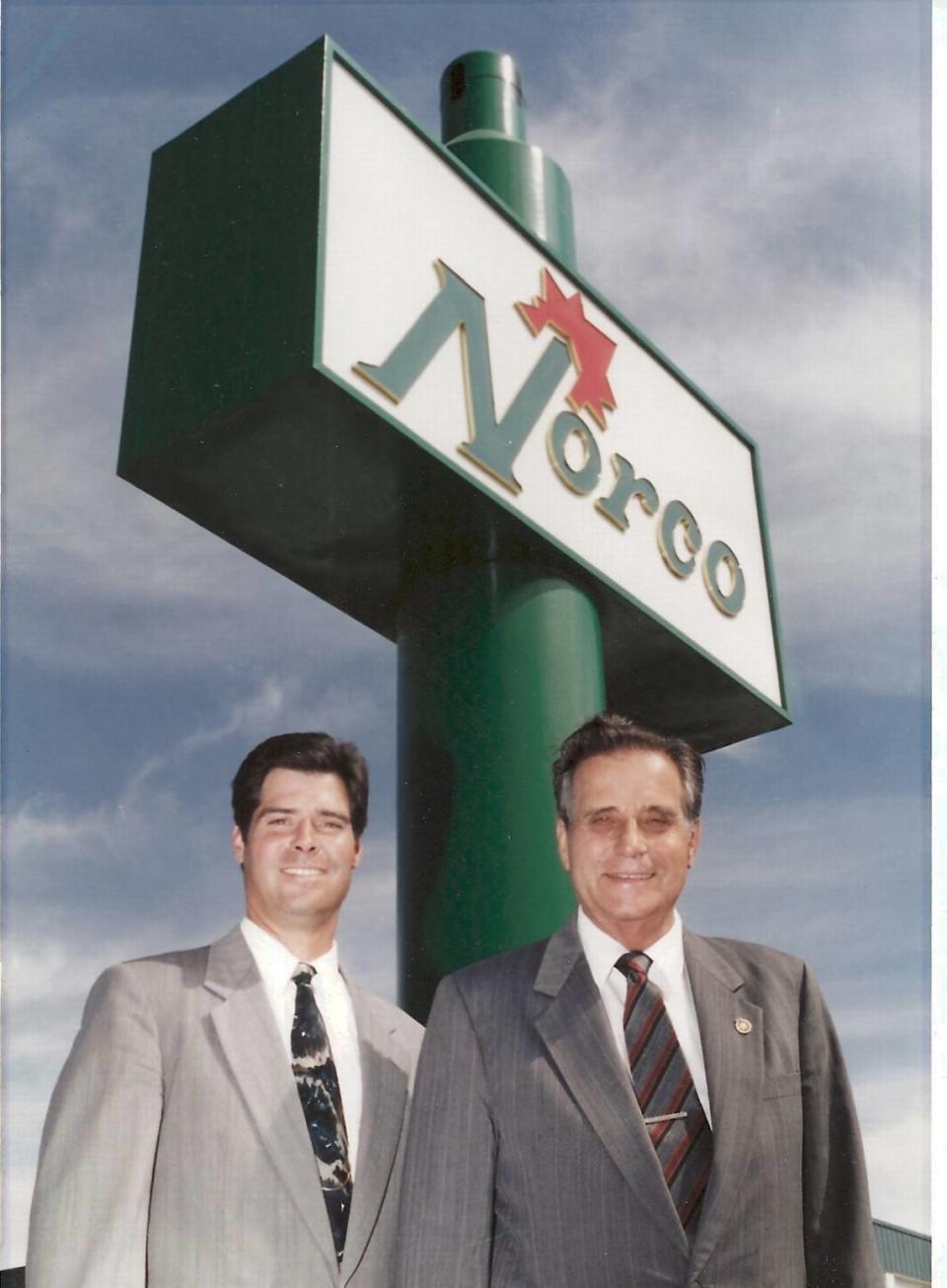

Kissler bought Norco from his father, Larry Kissler, in 1985. At the time of the transaction, he served as chairman of Norco’s board and had a 40% stake in the company.

Less than four years before the transaction, Kissler transferred 3,900 shares of non-voting Norco common stock to the McKenzie GT Trust, according to the lawsuit. He hired Willamette Management Associates to provide a fair market valuation of all Norco’s equity, which the firm determined in 2012 was $138.4 million.

When Kissler decided to sell most of his stocks in the company in 2015 to the employee stock ownership plan, he chose Ambrose Capital Partners to serve as a financial adviser to Norco in the sale.

The lawsuit said Ambrose valued the 35% equity stake in Norco, including the value of preferred dividends, at $139.1 million, more than the company’s entire assessed value just a few years earlier. But not long after, at a meeting regarding the transaction, Ambrose increased its valuation of the stake to $160.7 million. According to the lawsuit, the financial advisor gave a presentation to Norco and Kissler where it summarized Norco’s objectives in the transaction as creating a “liquidity event” for the sellers and exploring “all available tax benefits from the transaction, including the ability of the selling shareholders to defer capital gains taxes.”

Kissler told the Statesman that the company’s valuation had increased because it opened 38 new stores between the two appraisals. He said its stock has gone up for seven of the last eight years.

“The company grew like crazy during that period. Our sales grew and our earnings grew,” he said. “We are a very solid company in this community, and this lawsuit is dragging the Kissler name through the mud.”

He said the company tried to reach a settlement with Labor over the last few months but couldn’t come to an agreement.

Acting Labor Secretary Julie Sue asked that all losses to the employee stock ownership plan caused by Norco, Kissler, Alerus and the plan be restored, with interest. Sue also asked that a constructive trust or equitable lien be placed on the proceeds Kissler received from the transaction.

Labor’s attorneys on the case did not respond to phone calls requesting comment. Calls to a spokesperson at Alerus were not returned. None of the parties had filed a response in court as of Friday, Dec. 29.

“The Department of Labor will not hesitate to take legal action against fiduciaries who cause participants in employee stock ownership plans to overpay for employer stock,” Solicitor of Labor Seema Nanda said in a statement emailed to the Statesman on Tuesday. “The department’s investigation of this case revealed that Alerus rushed its review process, ignored a number of red flags indicating the transaction was overpriced and allowed the Norco plan to pay Mr. Kissler tens of millions of dollars more than the stock was worth. Our complaint seeks to have these fiduciaries make the plan whole for the overpayment they caused.”

A Boise medical practice fired her. She called it retaliation. Here’s what happened next

Ex-law professor sued U of I over alleged race, gender discrimination. They just settled

How an Eagle resident peddling a marijuana company was caught in a massive scam

FTC says Idaho firm’s data can track visits to abortion clinics. The firm fights back