Is grad school worth it? New research shows students left with unmanageable debt

Despite fierce debates over solutions to the country’s student debt crisis, Americans still tend to believe that going to college is worth it. The vast majority of people who have undergraduate degrees are better off financially than they would’ve been had they not attended college.

But what about graduate degrees? New research reveals many programs leave their participants with more debt than they initially borrowed, in jobs with incomes insufficient to pay off the balance.

Here’s what you need to know:

Many graduate students worse off than when they began master’s

Going to graduate school typically helps a student increase their salary prospects. That’s especially evident in, for example, medicine and law.

But the paper out Tuesday, which analyzed federal data for 1,661 higher education institutions and 6,371 graduate programs, shows that hundreds of colleges produce students who are worse off than when they started their master’s or professional degree. The research was conducted by the HEA Group, a college access consulting agency, and the National Student Legal Defense Network.

Specifically, researchers found:

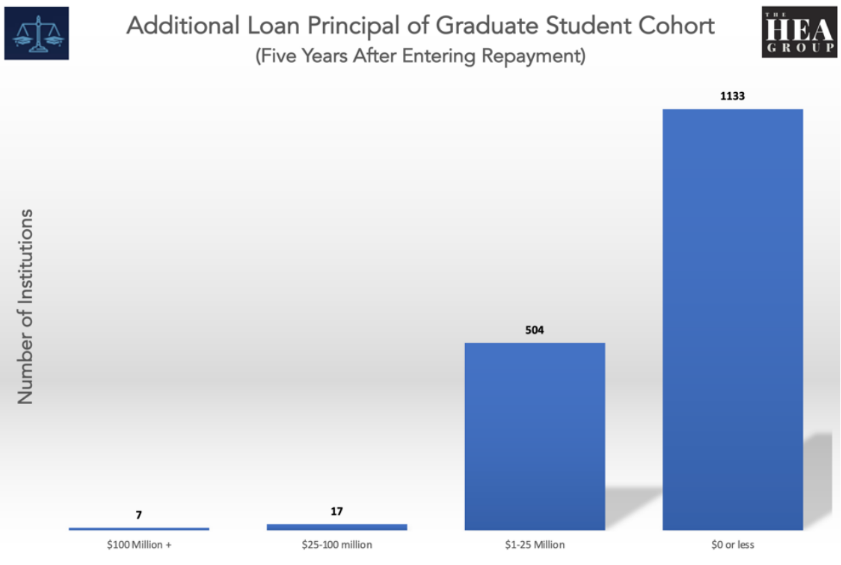

Roughly a third (32%) of the institutions studied show their former graduate students owing more on their loans than the amount they initially borrowed – even five years after entering repayment;

At two dozen institutions, former graduate students have accumulated more than $25 million in interest alone; and

Graduate programs at these institutions produce borrowers who owe more than $100 million in interest after five years: Walden University, University of Phoenix, Capella University, Strayer University, Liberty University, DeVry University and Nova Southeastern University. Most of these institutions are for-profit colleges or private nonprofits that used to operate as for-profits.

Biden administration plans crackdown on colleges that overload graduates with student debt

Interest: Why grad school debt snowballs

Federal graduate student loans come with higher interest rates than those for undergraduates. For this upcoming school year, graduate or professional school students who take out direct unsubsidized loans will be charged a fixed interest rate of 7.05%.

At most universities, graduate students are generally able to pay down at least some of their interest soon after completing their program. But at some institutions, that isn’t happening. When interest balloons, it’s often because the borrower is unable to make payments large enough to prevent their balance from growing.

“There are few protections in place to prevent students from owing too much while earning so little after earning their graduate credential,” the paper concludes. “With no checks and balances in place, this cycle where students take on massive amounts of debt – that they will never be able to fully pay back – will continue to occur.”

Nearly two decades ago, a Republican-controlled Congress essentially removed limits on graduate student loans, aiming to help more low- and middle-income people get graduate degrees. Earlier this year, a proposal by some Republicans in the Senate would curb that nearly unlimited borrowing power.

Student loan interest crisis? New bill could eliminate rates for many borrowers

Contact Alia Wong at (202) 507-2256 or awong@usatoday.com. Follow her on Twitter at @aliaemily.

This article originally appeared on USA TODAY: Graduate schools fuel student debt crisis. New research shows why.