Grainger (GWW) Q3 Earnings & Revenues Miss Estimates, Up Y/Y

W.W. Grainger, Inc. GWW posted third-quarter 2019 adjusted earnings per share (EPS) of $4.26, up 2% year over year. Earnings, however, missed the Zacks Consensus Estimate of $4.44, resulting in a negative surprise of 4%. Growth in operating earnings and lower average shares outstanding drove Grainger’s quarterly performance.

Including one-time items, such as restructuring and other charges, earnings came in at $4.25 in the reported quarter. The figure soared 134% from the year-ago quarter’s $1.82.

Grainger’s revenues jumped 4% to $2,947 million from the prior-year quarter’s $2,831 million. This upside was driven by an increase of 2.5 percentage point (pp) in volume. However, the revenue figure missed the Zacks Consensus Estimate of $2,950 million.

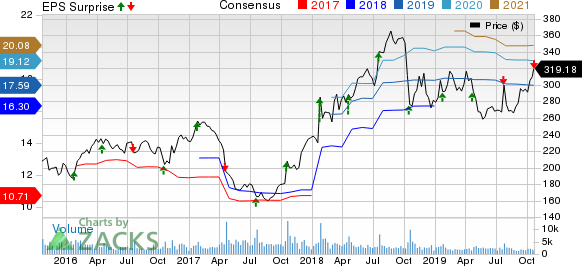

W.W. Grainger, Inc. Price, Consensus and EPS Surprise

W.W. Grainger, Inc. price-consensus-eps-surprise-chart | W.W. Grainger, Inc. Quote

Operational Update

Cost of sales increased 5.5% year over year to $1,848 million. Gross profit was up 1.8% year over year to $1,099 million. Gross margin shrunk to 37.3% in the quarter from the 38.1% reported in the year-ago quarter.

Grainger’s adjusted operating income in the July-September quarter increased 2% to $339 million from the $332 million witnessed in the prior-year quarter. Adjusted operating margin contracted 20 bps year on year to 11.5% in the quarter.

Financial Position

The company had cash and cash equivalents of $286 million at the end of the third quarter, down from $517 million at the prior-year quarter end. Cash provided by operating activities decreased to $320 million for the quarter from the year-ago quarter’s $348 million.

Long-term debt was $1,918 million as of Sep 30, 2019, compared with $2,090 million as of Dec 31, 2018. The company returned $279 million to shareholders through $79 million in dividends and $200 million to buy back around 725,000 shares in the reported quarter.

Outlook

Grainger has maintained its guidance for full-year 2019. Operating margin is forecasted in the band of 12.2-13.0%. The company expects EPS of $17.10-$18.70. Gross margin is estimated between 38.1% and 38.7%, and revenue growth is projected between 2% and 5%.

Price Performance

Over the past year, Grainger’s shares have gained 10.2%, outperforming the industry’s growth of 9.2%.

Zacks Rank and Stocks to Consider

Grainger currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Plug Power Inc. PLUG, Cintas Corporation CTAS and Sharps Compliance Corp SMED. While Plug Power sports a Zacks Rank #1 (Strong Buy), Cintas and Sharps Compliance carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Plug Power has a projected earnings growth rate of 2.8% for the current year. The stock has gained 139.5% so far this year.

Cintas has an estimated earnings growth rate of 12.74% for 2019. Shares of the company have rallied 58.9% year to date.

Sharps Compliance has an expected earnings growth rate of a whopping 500% for the ongoing year. The company has gained 21.5% so far this year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Plug Power, Inc. (PLUG) : Free Stock Analysis Report

Sharps Compliance Corp (SMED) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.