Granville, Heath, Johnstown-Monroe, Northridge school levies all approved by voters

Granville Exempted Village School district residents approved a five-year, income-tax renewal levy in Tuesday's primary/ special election, according to unofficial results.

Other school districts in Licking County passing levies Tuesday were Heath City Schools, Johnstown-Monroe Local Schools and Northridge Local Schools.

The Granville income-tax measure passed 55% to 45%, according to unofficial results from the Licking County Board of Elections.

Granville schools Superintendent Jeff Brown said Tuesday night that the district takes the responsibility of taxpayer dollars seriously.

"With this passage, we will continue that fiscal responsibility, being fiscally prudent and transparent with the taxpayer dollars so that the entire community has confidence in the fiscal aspects of our school district," he said.

The 0.75% income tax, which was first passed for five years in 2018, was set to expire Dec. 31. With the renewal, the rate stays the same for another five years with the term starting next Jan. 1.

The levy taxes all income, including some types of retirement income, such as IRA distributions and pensions. The tax does not affect Social Security benefits, disability and survivor benefits or workers' compensation benefits.

Election: Results for Licking County, including Granville, Buckeye Lake, Gratiot and more

This was the district's second try to pass the renewal after an attempt to renew the tax permenately failed 58% to 42% during the Nov. 8 general election.

The income tax accounts for about 20% of the district's revenue and is expected to generate about $7.5 million this year.

With the uncertainty surrounding not only the income tax levy but state funding and property taxes, Brown said during the March board meeting that the district won't fill all open positions because of a projected $2 million deficit.

Even with the income-tax levy now renewed, Brown said Tuesday the district will still be cautious with hiring and will only fill essential positions, such as transportation department positions and an assistant treasurer. He added that the administration will also look at the district's student enrollment numbers for the 2023-24 school to determine if any positions need added to handle additional growth.

Granville Board of Education President Thomas Miller thanked levy committee members at a watch party Tuesday night at Seek-No-Further Cidery. He said that despite some polarization in the community about the renewal, he is hoping Granville can rise above it going forward.

"We're all about our kids, and we've got to stay focused as a community on that. It'll pull us through anything," Miller said.

Granville resident Don Hunter said after voting Tuesday that he was in favor of the renewal because after property tax levies expired in 2018 in favor of the income tax, he is collectively paying less.

"I'm not going to vote against my own interests," he said.

Letitia Zurawick, whose children attend Granville schools, said she supported the renewal because Granville is the nice community that it is because of the school system.

"It's not going to stay this nice community if we don't have nice schools, and that affects our property taxes, property values — everything," she said.

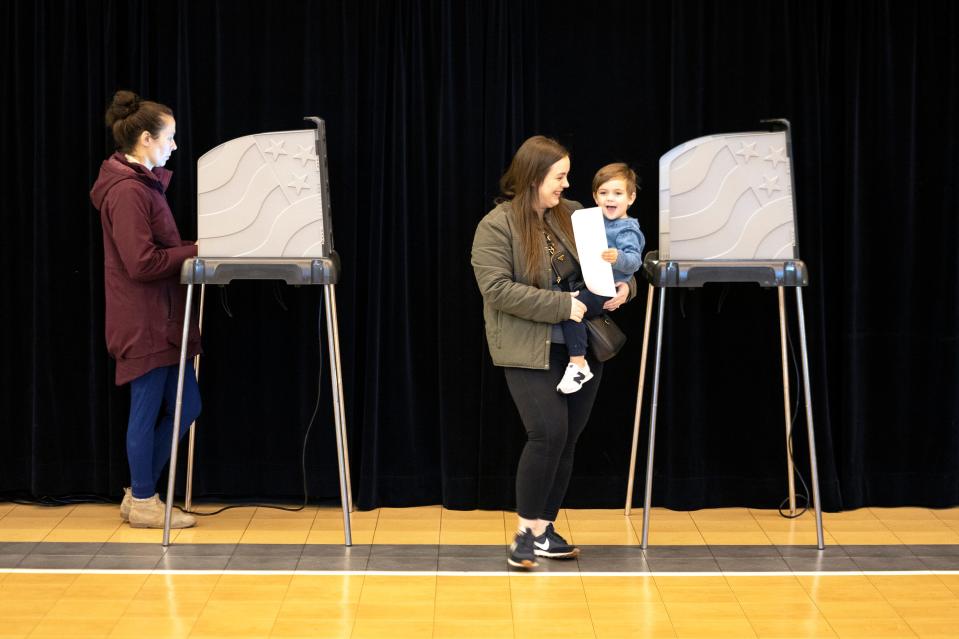

Chelsey Jones brought along her 2-year-old son, Asher, while she voted Tuesday at the Bryn Du Fieldhouse. She was in favor of the renewal because her oldest child, 5-year-old son Porter, enters kindergarten in the fall.

"We live here for the community and the schools, so (we'll) do whatever we need to keep the schools great," Jones said.

Granville resident Scott Dickerson said Granville schools provided a great education for his three grown children, but he opted to vote against the renewal because he wants to see a much broader district plan that looks several years into the future to deal with expected growth, not just one to two years ahead.

"Part of me feels like we kind of go about this piecemeal versus really trying to understand a more comprehensive plan," Dickerson said.

Dale Panko said that even though he voted against the renewal tax, he does still support the school district. He added that he would prefer the district pursue an earned income tax levy instead to protect retirees like himself from having portions of their retirement taxed.

With inflation and rising costs, Panko said retirees and others on fixed incomes are losing buying power every day.

District voters rejected an earned income tax in May 2018 prior to the 0.75% income tax passing later that year.

Brown said an all income-tax levy is the best option for the community because this adjusts with the economic conditions.

"When the community is doing well, the schools will have a little bit more revenue. When the community might not be doing well, we will get less revenue and we'll adjust our economic conditions," he said.

Heath, Johnstown-Monroe, Northridge all see levies pass

Rather than trying to pass renewal levies in 2024 and 2027, Heath successfully combined the two into a 14.5-mill substitute levy. It passed 404-300 Tuesday, or 57% to 43%, according to unofficial results.

The 2007 issue raised $2.5 million, and the new levy in 2013 produced $2 million. Up for renewal in 2024 and 2027, those now go away. The same amount of money will be collected, and there will be no tax increase for existing homeowners.

"We are so fortunate to have the support of the Heath community. We have a very strong district, and amazing students," Superintendent Trevor Thomas said Tuesday night. "Our levy committee was phenomenal and took charge of this effort, and the result reflects that. I’m so proud of Heath schools!"

Voters in the Johnstown-Monroe school district actually passed two renewals on Tuesday, a 1% income tax levy and a 4.8-mill, $2.2-million emergency property tax levy. The income-tax measure was approved by 840-545, or 61% to 39%, while the property tax levy passed by an 810-576 vote, or 58% to 42%, according to unofficial results.

Both are existing levies, previously approved by Johnstown-Monroe voters, that are set to expire within the next two years. They will fund day-to-day operations for the district without increasing current tax levels. The two levies currently generate a combined $7.1 million annually – which represents approximately 30% of the district’s annual operating expenses. Johnstown's enrollment, currently more than 1,700 students, has increased by about 150 students since 2017.

"The passage of the two ballot issues will allow the district to continue the quality education our families, community and staff have come to expect, and provide a funding bridge as we prepare for future growth and economic development," Superintendent Philip Wagner said. "We thank our community for its confidence and support of the Johnstown-Monroe School District."

Northridge Local School District voters approved a 5.5-mill property tax renewal for five years. The measure passed 699 votes to 556, or 56% to 44%. Superintendent Scott Schmidt said the renewal represents no tax increase and funds day-to-day operations, including teacher salaries, instructional supplies and technology.

Advocate reporter Dave Weidig contributed to this story.

mdevito@gannett.com

740-607-2175

Twitter: @MariaDeVito13

This article originally appeared on Newark Advocate: Granville, Heath, other school levies all prevail in May election