Gravita India (NSE:GRAVITA) Seems To Be Using An Awful Lot Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Gravita India Limited (NSE:GRAVITA) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Gravita India

How Much Debt Does Gravita India Carry?

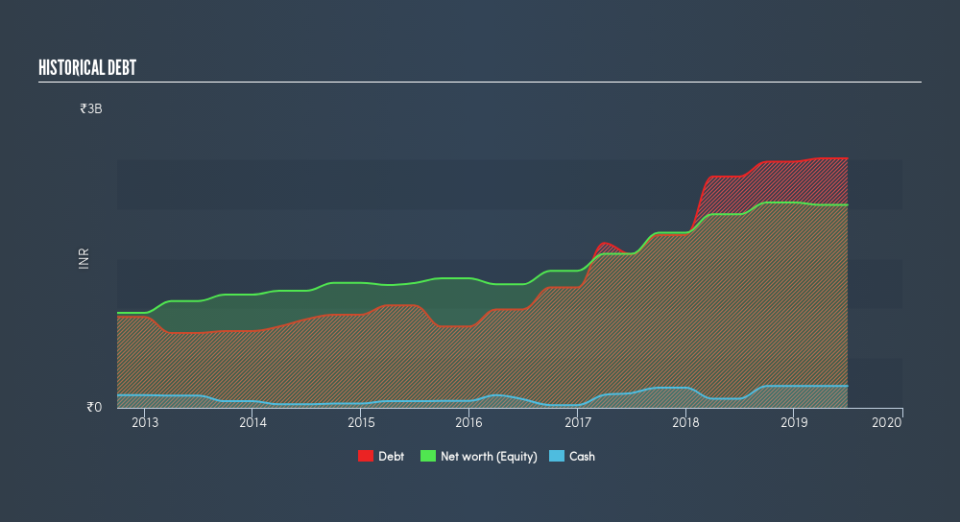

The image below, which you can click on for greater detail, shows that at March 2019 Gravita India had debt of ₹2.51b, up from ₹2.33b in one year. However, it also had ₹218.7m in cash, and so its net debt is ₹2.29b.

A Look At Gravita India's Liabilities

We can see from the most recent balance sheet that Gravita India had liabilities of ₹3.35b falling due within a year, and liabilities of ₹338.3m due beyond that. Offsetting these obligations, it had cash of ₹218.7m as well as receivables valued at ₹973.9m due within 12 months. So it has liabilities totalling ₹2.49b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₹2.58b, so it does suggest shareholders should keep an eye on Gravita India's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Gravita India's net debt to EBITDA ratio of 4.8, we think its super-low interest cover of 1.6 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, Gravita India's EBIT was down 57% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Gravita India can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Gravita India burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Gravita India's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And furthermore, its net debt to EBITDA also fails to instill confidence. After considering the datapoints discussed, we think Gravita India has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Over time, share prices tend to follow earnings per share, so if you're interested in Gravita India, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.