Group of Spartanburg County Republicans oppose penny tax for roads, bridges. Here's why.

Some Spartanburg County Republicans are taking a stand against new taxes and have voted to oppose the county's proposed 1-cent sales tax to pay for road repairs.

Last month, County Council unanimously agreed to a referendum to ask voters to support or oppose the tax during the election on Nov. 7. If approved, the 1% tax would last six years and raise $487 million to fix 547 roads, bridges and intersections.

At a Spartanburg County GOP executive committee meeting Sept. 21, nearly a third of the representatives from the county's 112 precincts voted to oppose the referendum, according to county GOP chairman Curtis Smith.

"What they wanted was no more taxes, that the government has too much of our money," Smith said of the referendum opponents.

Smith said Republicans from 46 of the 112 precincts attended the meeting. He said there was no plan to take a vote, but a motion came up to "not support" the penny tax. The outcome was 32-8.

"The party did not adopt a resolution," Smith said. "The precincts that came in were adamant about any taxes. Republicans do not want increased taxes. We believe there's enough money if it's managed properly."

Smith said he urges voters to listen to both sides of the penny sales tax argument before deciding how to vote.

Supporters urge passage of penny tax

Supporters of the penny tax have said fixing roads is a top priority, and the penny tax is less painful than raising property taxes.

They estimate a third of the penny tax revenues to come from out-of-town shoppers. Grocery items and prescription drugs are not subject to the tax.

The new tax would take effect May 1, 2024, the day after the current six-year penny tax expires. That tax, approved by voters in 2017 by a margin of 63% to 37%, has provided funding for a new courthouse, a new city-county government complex and a new city police station.

Allen Smith, president and CEO of OneSpartanburg, Inc., said the chamber strongly supports the tax.

"We can fix our roads by voting yes to continue the 1 percent sales tax from 2017," Smith said. "The referendum process has been transparent from day one, and all 577 projects can be found at voteyesspartanburg.com or the county website.

"Chances are a road, bridge or intersection near you will be addressed if the Nov. 7 referendum passes," Smith said.

Smith said there will be a caffeinated conversation on the penny sales tax referendum at OneSpartanburg, Inc.'s Milliken Board Room at 8:30 a.m. Tuesday, Oct. 10.

Council chairman Lynch: Let voters decide

Manning Lynch, chairman of the County Council, said it will be the voters who decide whether to approve the tax and not County Council.

"County Council has asked this question in the form of a referendum for the voters," Lynch said. "if voters don't vote for it, it won't be.

"It is a primary function of government to do roads and bridges," Lynch added. "If you look at how the penny worked on the courthouse and other buildings and leaving no debt, I would say it worked fairly well."

Two years ago, County Council abolished the long-unpopular $25 vehicle fee. Council then agreed to borrow $30 million in 2021 and $30.3 million this year to pay for road projects not included on the penny tax list.

The County Council agreed to repay the money by increasing the debt service levy on homeowners' tax bills. Two years ago, the debt service levy was increased by 2 mills, bringing the total to 6.7 mills from 4.7 mills — roughly $12 a year, according to County Administrator Cole Alverson.

Opponents: Penny tax not needed

Some residents believe the county can afford to fix roads without a property tax or a sales tax increase.

Dr. Bill Bledsoe, who attended the Sept. 21 GOP meeting, said he examined county budgets dating back to 2003 and found that "the county road budget is massively underfunded."

In the past 20 years, he said there have been only five times when the county spent more on roads than the national average of 6.5%.

"The money's always been there," Bledsoe said. "In my mind, that's either malfeasance or incompetence. They've jeopardized our children for a penny tax."

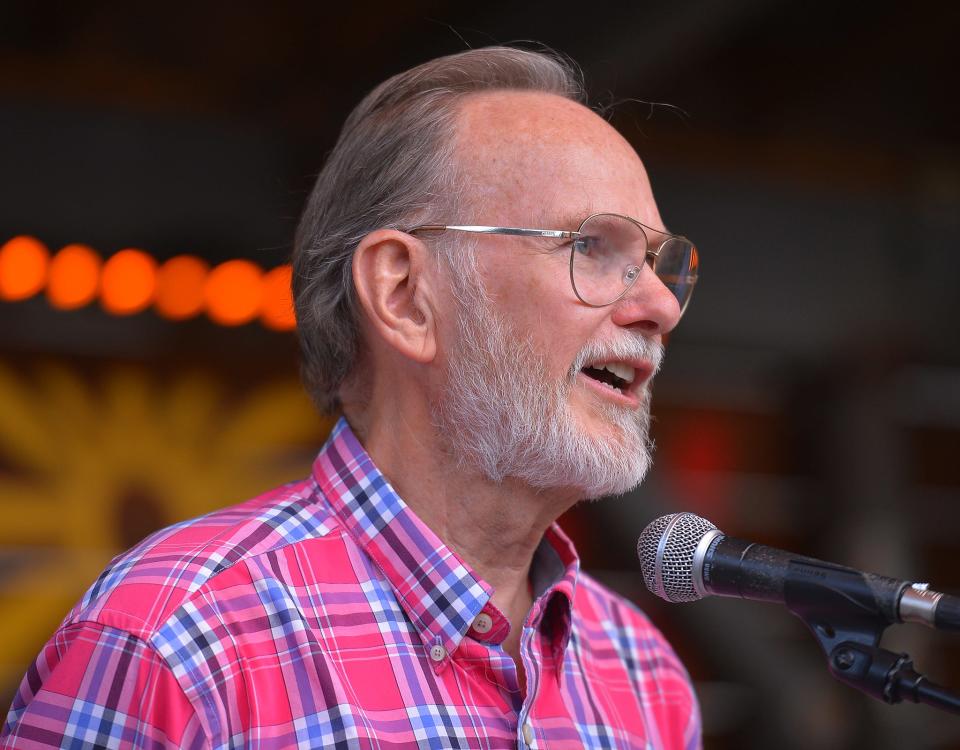

Former Republican lawmaker Lee Bright of Roebuck, who did not attend the GOP's Sept. 21 meeting, said he doesn't understand why roads are not in better shape — especially since the state approved a 12-cent gas tax increase several years ago.

"Look at the money the state's blowing through," said Bright, former District 12 state senator.

Bright noted that some of the road projects to be funded by the penny tax are state roads. County officials said that is because local funds will help speed up projects on the state's list.

"Why would the county want to pay for state roads when the state is running these surpluses and getting into Minor League Baseball," Bright said. "The spending's got to stop. "They promised this 1% to the courthouse, not it's going to sunset, and they want to keep it. It goes to show once they get the money, they don't want to give it back."

Bob Montgomery covers Spartanburg County politics and growth & development. Reach him via email at bob.montgomery@shj.com.

This article originally appeared on Herald-Journal: Spartanburg Republicans: Just say no to penny tax for county roads