GrowGeneration (GRWG) Terminates HGS Buyout, Updates 2021 View

GrowGeneration Corp. GRWG recently announced that the company and HGS Hydro have mutually agreed to terminate their previously announced asset purchase agreement on Jul 28, 2021. Considering the impact of this decision, GrowGeneration lowered its revenue guidance, which is now anticipated in the range of $440 million to $452 million. In another move, the company has acquired All Seasons Gardening, thus foraying into New Mexico’s growing cannabis market.

HGS Hydro is the largest chain of hydroponic garden centers in the state of Michigan and generated approximately $50 million in revenues in 2020. The buyout, if completed, would have made Michigan GrowGeneration's second largest state behind California. GrowGeneration informed that it has decided to mutually terminate the acquisition following appropriate due diligence and capital allocation analysis.

To reflect this move, GrowGeneration updated its third-quarter revenue guidance for 2021 to $114 million to $116 million. Full-year revenue guidance has been revised to $440 million to $452 million, from the prior view of $455 million-$475 million.

The company added that same-store sales for the third quarter were up more than 15% year over year. For the fourth quarter, revenue guidance is projected to be $110-$120 million. For 2021, adjusted EBITDA is expected between $47 million and $51 million.

All Seasons Gardening Buyout: A Foray into New Mexico

GrowGeneration announced that it has acquired All Seasons Gardening, the largest hydroponics retailer in New Mexico. Operating since 2010, All Seasons Gardening is an indoor-outdoor garden supply center specializing in hydroponics systems, lighting, and nutrients. This buyout takes GrowGeneration's store tally of hydroponic garden centers to 63 across 13 states. It is GrowGeneration’s 14th acquired location this year. This also marks the company’s foray in the promising New Mexico's cannabis market. It opens up new growth avenues for the company given that New Mexico’s cannabis market is projected to become a $1 billion industry by 2026.

The company continues to aggressively expand the number of its retail garden centers. The company seems well on track to meet its goal of having 70 locations by this year-end. GrowGeneration plans to take it up to 100 locations by 2023. It has also been building online sales, with visitors to its website trending more than 150,000 per month. The company’s continued focus on rapid and strategic growth in key markets, both organically and through acquisitions, have been driving revenues (online, commercial and retail) and will continue to do so in the near future.

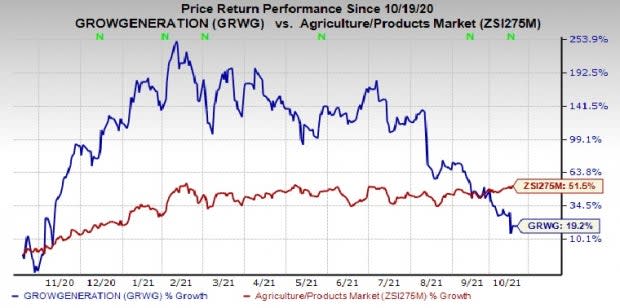

Share Price Performance

Over the past year, GrowGeneration has gained 19.2% compared with the industry’s rally of 51.5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

GrowGeneration currently carried a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space include Nucor Corporation NUE, Methanex Corporation MEOH and Celanese Corporation CE. While Nucor and Methanex sport a Zacks Rank #1 (Strong Buy), Celanese carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has an estimated earnings growth rate of 537.4 % for the ongoing year. So far this year, the company’s shares have appreciated 82.9%.

Methanex has a projected earnings growth rate of 409.3 % for 2021. The company’s shares have gained 6% so far this year.

Celanese has an estimated earnings growth rate of 122.3% for the current year. The company’s shares have gained 28.6%, year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GrowGeneration Corp. (GRWG) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research