The Gulf Oil Lubricants India (NSE:GULFOILLUB) Share Price Has Gained 186%, So Why Not Pay It Some Attention?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Gulf Oil Lubricants India Limited (NSE:GULFOILLUB) which saw its share price drive 186% higher over five years. We note the stock price is up 2.9% in the last seven days.

Check out our latest analysis for Gulf Oil Lubricants India

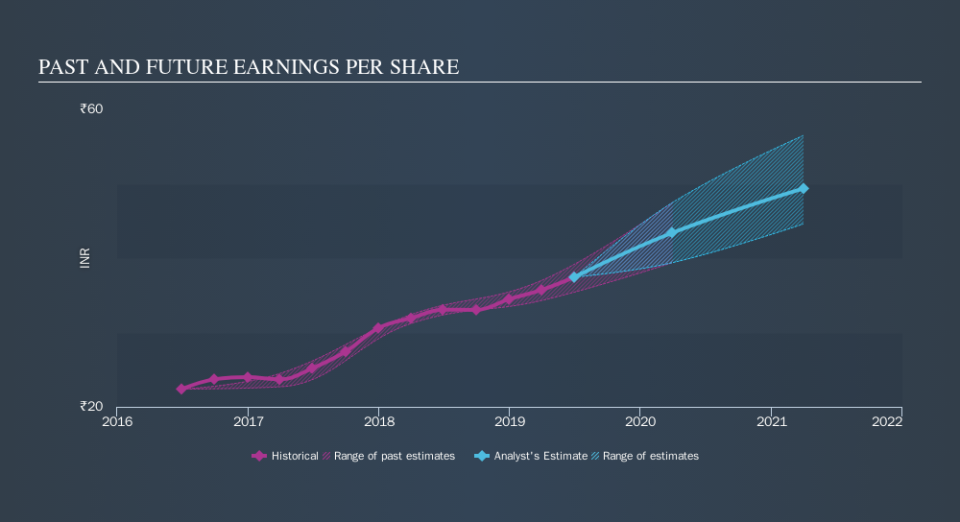

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Gulf Oil Lubricants India became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Gulf Oil Lubricants India share price is up 16% in the last three years. In the same period, EPS is up 19% per year. This EPS growth is higher than the 5.2% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Gulf Oil Lubricants India has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Gulf Oil Lubricants India's TSR for the last 5 years was 202%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Gulf Oil Lubricants India has rewarded shareholders with a total shareholder return of 24% in the last twelve months. That's including the dividend. Having said that, the five-year TSR of 25% a year, is even better. Before spending more time on Gulf Oil Lubricants India it might be wise to click here to see if insiders have been buying or selling shares.

Of course Gulf Oil Lubricants India may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.