Jeffrey Gundlach: The US stock market ‘will get crushed’ in the next recession

Influential bond investor Jeffrey Gundlach, the CEO of $150 billion DoubleLine Capital, sees a scenario where U.S. stocks get crushed in the next recession — and likely won't recover for quite some time to come.

Even with Wall Street benchmarks just days removed from new record highs, the bearish investor declared that “the pattern of the United States outperforming the rest the world has already come to an end.”

In an exclusive interview with Yahoo Finance, Gundlach noted that 2019 was one of the "easiest" years ever for investors in "just about anything... Just throw a dart, and you're up 15-20%, not just the United States, but global stocks as well."

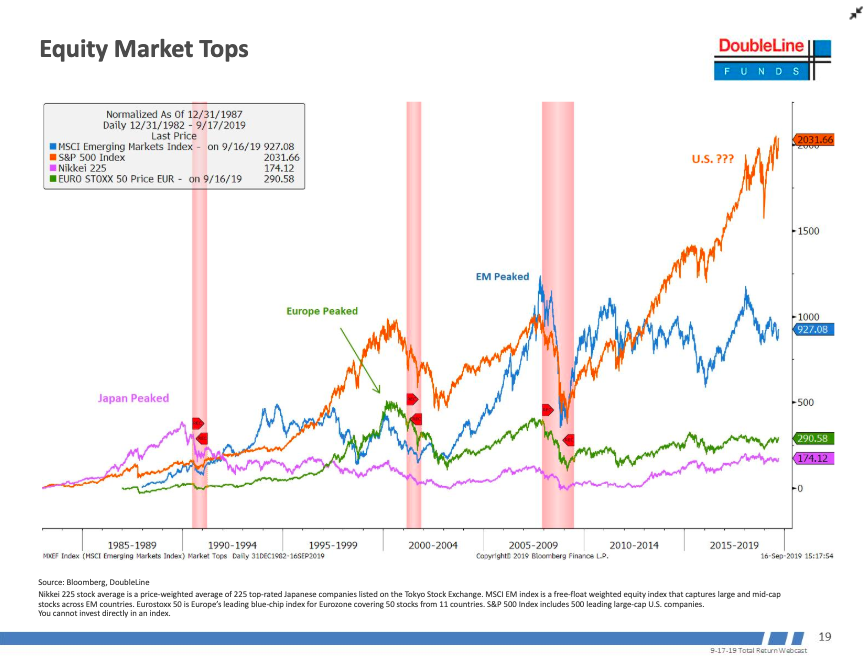

For several reasons, Gundlach warned that pattern isn’t likely to last forever. He added that investors should consider a pattern he highlights in his "chart of the year,” which divides the world into four regions — the United States, Japan, Europe, and Emerging Markets — and looks at the major stock market indices.

And what that shows is a pattern where the Nikkei 225 (^N225), the Euro Stoxx 50 Index, and the MSCI Emerging Markets index all peaked before a recession — but never recovered to pre-recession levels. The same fate might befall the S&P 500 Index (^GSPC) in the U.S., according to Gundlach.

"So, where are we today? Today, we have the S&P 500 is killing everybody else over the last ten years, almost 100% outperformance versus most other stock markets,” he explained to Yahoo Finance.

“My belief is that pattern will repeat itself,” said Gundlach, who has spent much of 2019 warning of a downturn ahead of the 2020 elections.

“In other words, when the next recession comes, the United States will get crushed, and it will not make it back to the highs that we've seen, that we're floating around right now, probably for the rest of my career, is what I think is going to happen,” he added — suggesting that a recovery won’t be seen for years.

While the 60-year old bond king expects a rotation into non-U.S. stocks, he also believes that the U.S. dollar, which has been "remarkably stable" in 2019, will eventually weaken as investors start to worry about the massive federal debt spending.

"I think in the next recession the dollar will fall because of the deficit problem United States, and that investors will be better served to own foreign stock markets instead of the U.S. stock market in dealing with the next recession,” Gundlach added.

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.