Our Take On H & M Hennes & Mauritz AB (publ)'s (STO:HM B) CEO Salary

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Karl-Johan Persson became the CEO of H & M Hennes & Mauritz AB (publ) (STO:HM B) in 2009. First, this article will compare CEO compensation with compensation at other large companies. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for H & M Hennes & Mauritz

How Does Karl-Johan Persson's Compensation Compare With Similar Sized Companies?

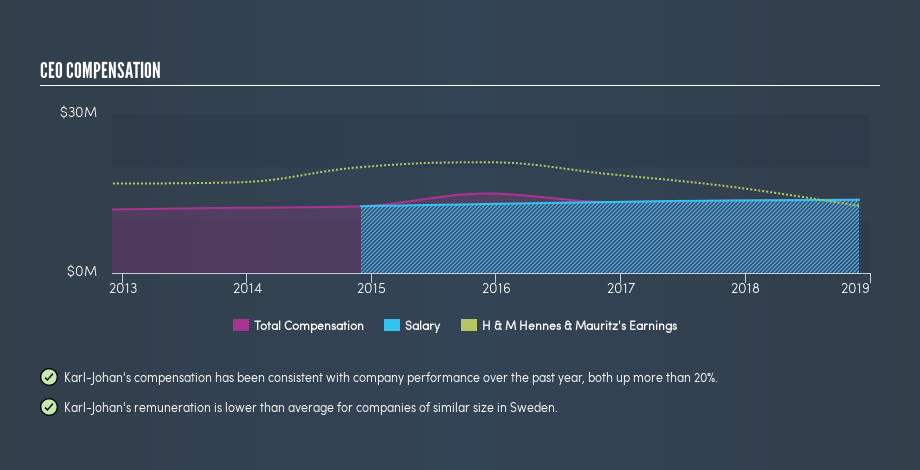

According to our data, H & M Hennes & Mauritz AB (publ) has a market capitalization of kr281b, and pays its CEO total annual compensation worth kr14m. (This is based on the year to November 2018). It is worth noting that the CEO compensation consists almost entirely of the salary, worth kr14m. We took a group of companies with market capitalizations over kr75b, and calculated the median CEO total compensation to be kr21m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts - even though some are quite a bit bigger than others).

This would give shareholders a good impression of the company, since most large companies pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at H & M Hennes & Mauritz has changed over time.

Is H & M Hennes & Mauritz AB (publ) Growing?

On average over the last three years, H & M Hennes & Mauritz AB (publ) has shrunk earnings per share by 17% each year (measured with a line of best fit). It achieved revenue growth of 10% over the last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for me to put aside my concerns around earnings. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Shareholders might be interested in this free visualization of analyst forecasts.

Has H & M Hennes & Mauritz AB (publ) Been A Good Investment?

Since shareholders would have lost about 25% over three years, some H & M Hennes & Mauritz AB (publ) shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

It appears that H & M Hennes & Mauritz AB (publ) remunerates its CEO below most large companies.

Shareholders should note that compensation for Karl-Johan Persson is below the median of larger companies. But then, EPS growth is lacking and so are the returns to shareholders. Considering all these factors, we'd stop short of saying the CEO pay is too high, but we don't think shareholders would want to see a pay rise before business performance improves. So you may want to check if insiders are buying H & M Hennes & Mauritz shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.