The Habit Restaurants (NASDAQ:HABT) Share Price Is Down 38% So Some Shareholders Are Getting Worried

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term The Habit Restaurants, Inc. (NASDAQ:HABT) shareholders, since the share price is down 38% in the last three years, falling well short of the market return of around 48%. On top of that, the share price is down 5.1% in the last week.

View our latest analysis for Habit Restaurants

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Habit Restaurants became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 18% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Habit Restaurants more closely, as sometimes stocks fall unfairly. This could present an opportunity.

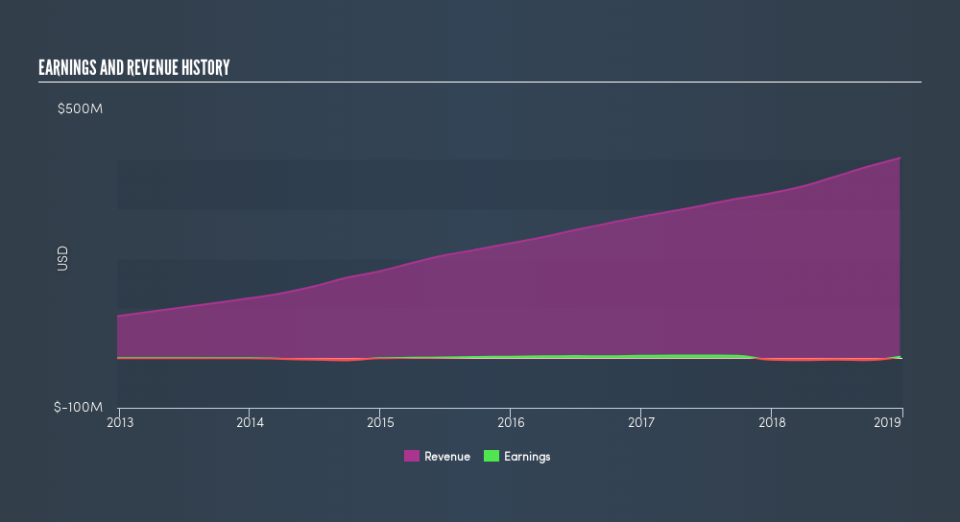

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We know that Habit Restaurants has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Habit Restaurants in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Habit Restaurants shareholders have gained 10% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 15% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. If you would like to research Habit Restaurants in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.