If You Had Bought Adani Green Energy (NSE:ADANIGREEN) Stock A Year Ago, You'd Be Sitting On A 18% Loss, Today

While it may not be enough for some shareholders, we think it is good to see the Adani Green Energy Limited (NSE:ADANIGREEN) share price up 25% in a single quarter. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 18% in the last year, significantly under-performing the market.

See our latest analysis for Adani Green Energy

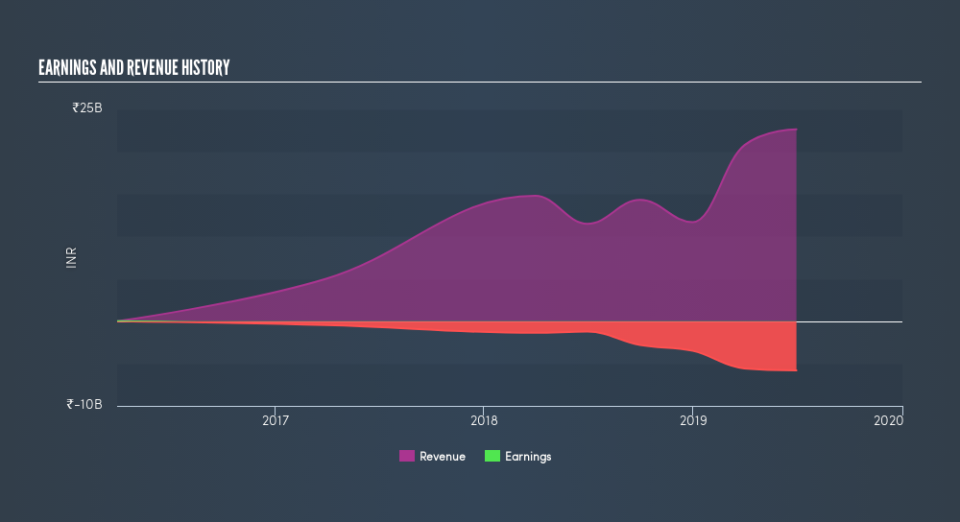

Adani Green Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Adani Green Energy grew its revenue by 97% over the last year. That's well above most other pre-profit companies. The share price drop of 18% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Adani Green Energy shareholders are down 18% for the year, even worse than the market loss of 9.7%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 25%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before spending more time on Adani Green Energy it might be wise to click here to see if insiders have been buying or selling shares.

Of course Adani Green Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.