If You Had Bought Aega (OB:AEGA) Shares Five Years Ago You'd Have A Total Return Of 1.9%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is doubtless a positive to see that the Aega ASA (OB:AEGA) share price has gained some 53% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 83% in that time, significantly under-performing the market.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Aega

Aega recorded just €3,279,849 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Aega will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Aega has already given some investors a taste of the bitter losses that high risk investing can cause.

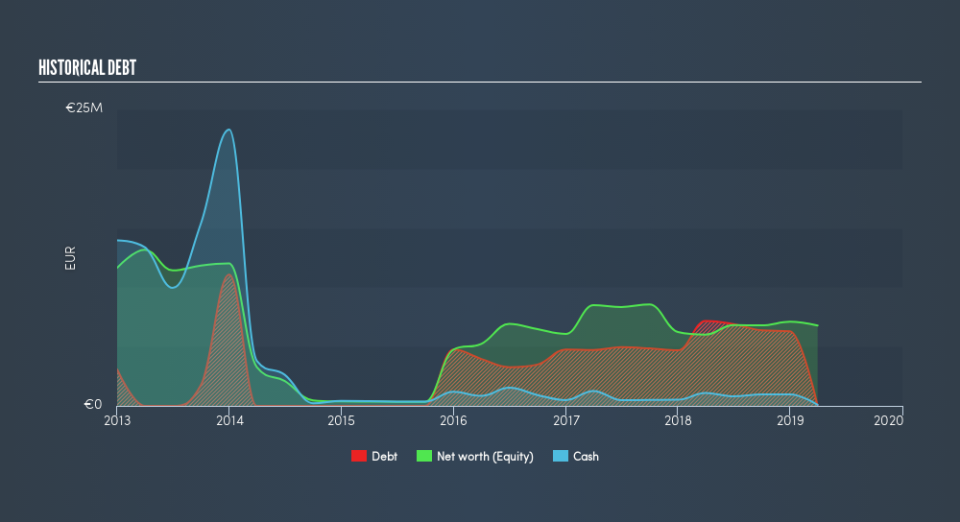

Our data indicates that Aega had €14,532,489 more in total liabilities than it had cash, when it last reported in March 2019. That puts it in the highest risk category, according to our analysis. But since the share price has dived -30% per year, over 5 years, it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Aega's cash levels have changed over time. You can see in the image below, how Aega's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Aega generated a TSR of 1.9%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We're pleased to report that Aega shareholders have received a total shareholder return of 45% over one year. That's better than the annualised return of 0.4% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You could get a better understanding of Aega's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.