If You Had Bought Akoustis Technologies (NASDAQ:AKTS) Shares Three Years Ago You'd Have Made 55%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Akoustis Technologies, Inc. (NASDAQ:AKTS) shareholders might be concerned after seeing the share price drop 16% in the last quarter. But we wouldn't complain about the gain over the last three years. It beat the market return of 47% in that time, gaining 55%.

Check out our latest analysis for Akoustis Technologies

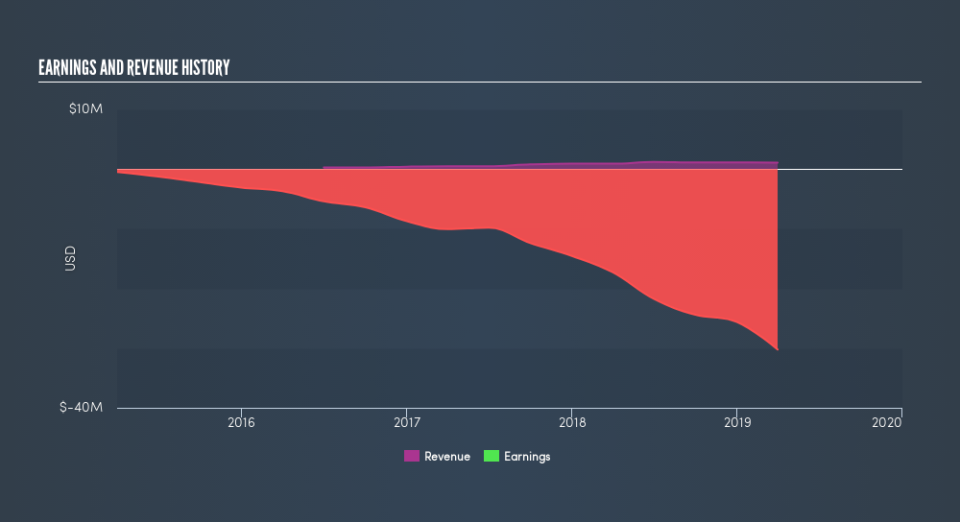

Given that Akoustis Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Akoustis Technologies's revenue trended up 50% each year over three years. That's well above most pre-profit companies. The share price rise of 16% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put Akoustis Technologies on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Akoustis Technologies in this interactive graph of future profit estimates.

A Different Perspective

The last twelve months weren't great for Akoustis Technologies shares, which cost holders 37%, while the market was up about 6.4%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 16% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Akoustis Technologies by clicking this link.

Akoustis Technologies is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.