If You Had Bought Alteryx (NYSE:AYX) Stock Three Years Ago, You Could Pocket A 154% Gain Today

Alteryx, Inc. (NYSE:AYX) shareholders might be concerned after seeing the share price drop 24% in the last month. In contrast, the return over three years has been impressive. Indeed, the share price is up a very strong 154% in that time. So the recent fall in the share price should be viewed in that context. If the business can perform well for years to come, then the recent drop could be an opportunity.

View our latest analysis for Alteryx

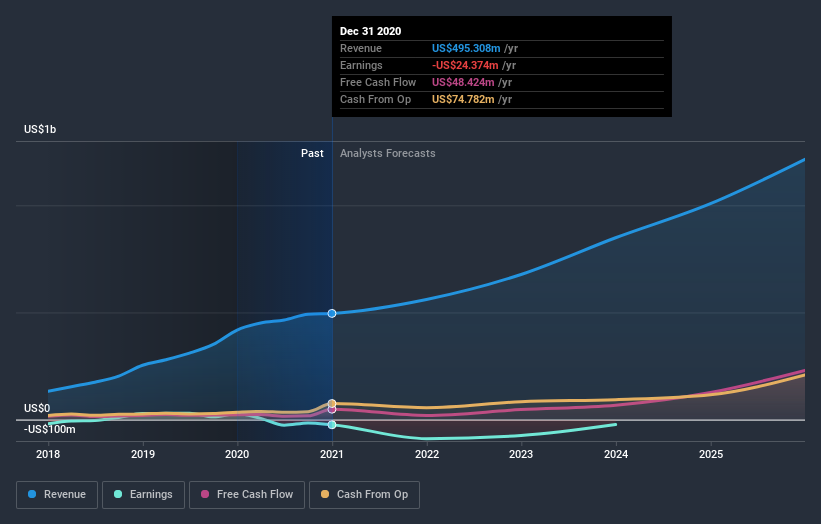

Because Alteryx made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Alteryx has grown its revenue at 42% annually. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 36% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Alteryx stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

The last twelve months weren't great for Alteryx shares, which cost holders 34%, while the market was up about 45%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 36% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Alteryx (including 1 which is potentially serious) .

Of course Alteryx may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.