If You Had Bought American Outdoor Brands (NASDAQ:AOBC) Stock Three Years Ago, You'd Be Sitting On A 56% Loss, Today

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term American Outdoor Brands Corporation (NASDAQ:AOBC) shareholders. Unfortunately, they have held through a 56% decline in the share price in that time. The falls have accelerated recently, with the share price down 23% in the last three months.

View our latest analysis for American Outdoor Brands

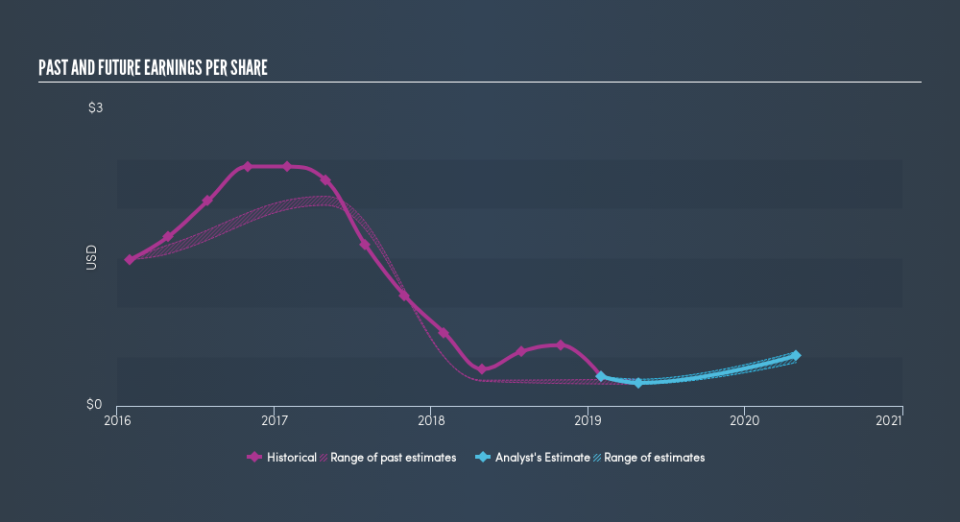

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

American Outdoor Brands saw its EPS decline at a compound rate of 41% per year, over the last three years. This fall in the EPS is worse than the 24% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into American Outdoor Brands's key metrics by checking this interactive graph of American Outdoor Brands's earnings, revenue and cash flow.

A Different Perspective

Investors in American Outdoor Brands had a tough year, with a total loss of 14%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.5% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research American Outdoor Brands in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.