If You Had Bought Aviat Networks (NASDAQ:AVNW) Shares Three Years Ago You'd Have Made 59%

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Aviat Networks, Inc. (NASDAQ:AVNW) share price is up 59% in the last three years, clearly besting than the market return of around 39% (not including dividends).

View our latest analysis for Aviat Networks

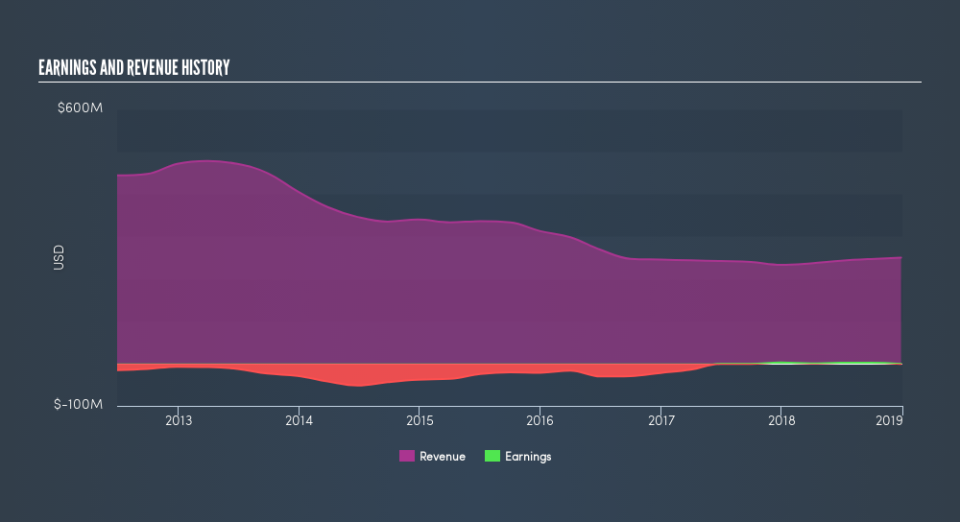

Because Aviat Networks is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Aviat Networks actually saw its revenue drop by 6.9% per year over three years. Despite the lack of revenue growth, the stock has returned 17%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 12% in the last year, Aviat Networks shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5.1% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before spending more time on Aviat Networks it might be wise to click here to see if insiders have been buying or selling shares.

But note: Aviat Networks may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.