If You Had Bought Barak Valley Cements (NSE:BVCL) Stock Three Years Ago, You'd Be Sitting On A 57% Loss, Today

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Barak Valley Cements Limited (NSE:BVCL) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 57% share price collapse, in that time. And over the last year the share price fell 30%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

Check out our latest analysis for Barak Valley Cements

We don't think that Barak Valley Cements's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Barak Valley Cements grew revenue at 6.3% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 24% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

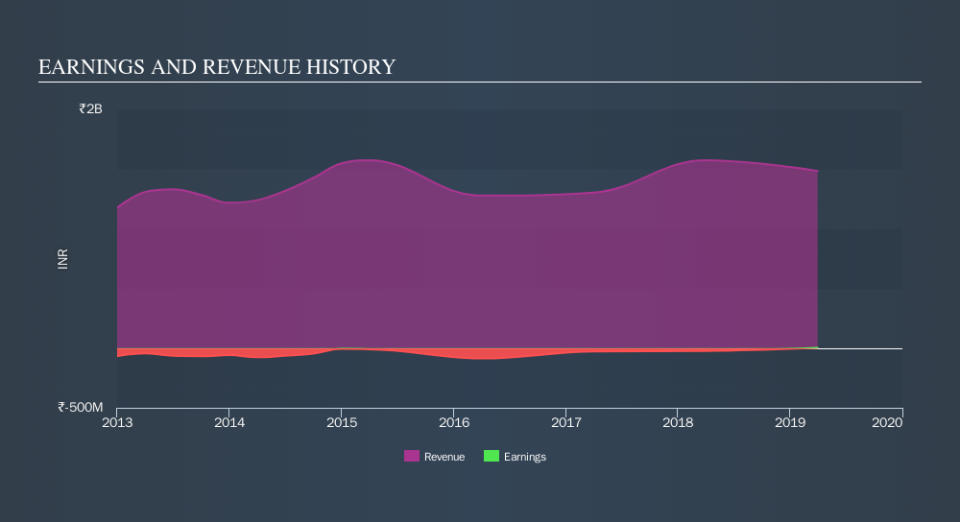

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Barak Valley Cements had a tough year, with a total loss of 30%, against a market gain of about 8.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3.8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Barak Valley Cements scores on these 3 valuation metrics.

But note: Barak Valley Cements may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.