If You Had Bought Beijing Capital International Airport (HKG:694) Stock Five Years Ago, You Could Pocket A 24% Gain Today

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Beijing Capital International Airport Company Limited (HKG:694) share price is up 24% in the last 5 years, clearly besting the market return of around -1.2% (ignoring dividends).

See our latest analysis for Beijing Capital International Airport

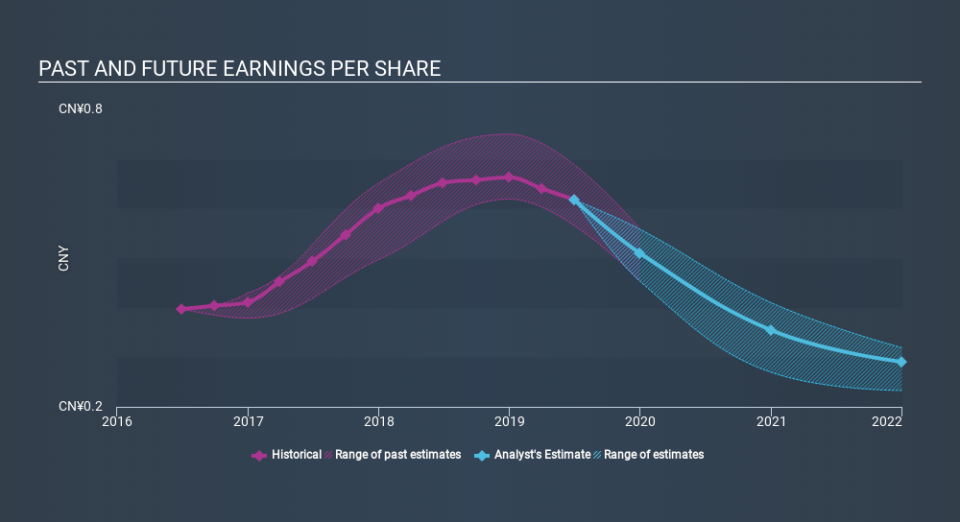

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Beijing Capital International Airport managed to grow its earnings per share at 15% a year. This EPS growth is higher than the 4.3% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 10.94 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Beijing Capital International Airport's key metrics by checking this interactive graph of Beijing Capital International Airport's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Beijing Capital International Airport the TSR over the last 5 years was 43%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Beijing Capital International Airport shareholders are down 9.3% for the year (even including dividends) , but the market itself is up 2.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 7.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Importantly, we haven't analysed Beijing Capital International Airport's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Beijing Capital International Airport may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.