If You Had Bought Butterfly Gandhimathi Appliances (NSE:BUTTERFLY) Stock A Year Ago, You'd Be Sitting On A 66% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. And there's no doubt that Butterfly Gandhimathi Appliances Limited (NSE:BUTTERFLY) stock has had a really bad year. To wit the share price is down 66% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 7.0% in three years. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Check out our latest analysis for Butterfly Gandhimathi Appliances

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Butterfly Gandhimathi Appliances grew its earnings per share, moving from a loss to a profit. Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. But we may find different metrics more enlightening.

Butterfly Gandhimathi Appliances's revenue is actually up 20% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

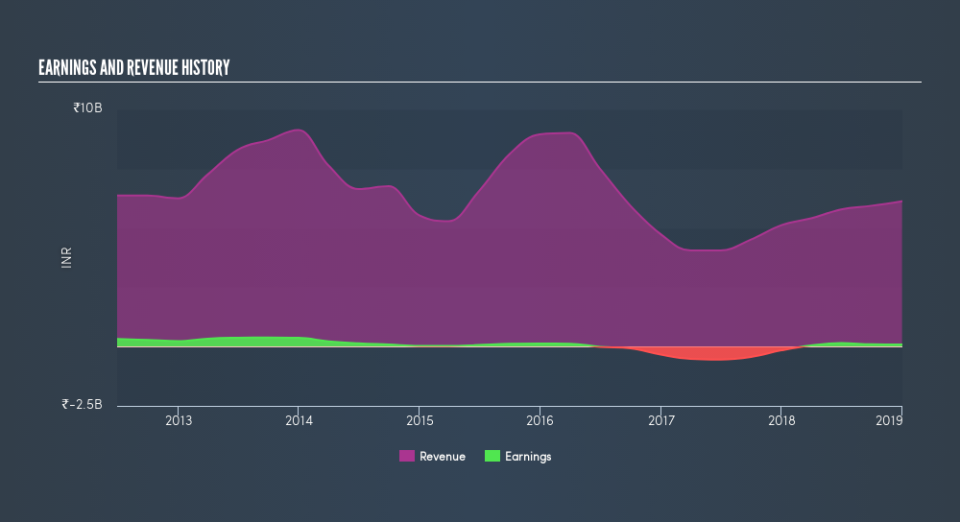

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Butterfly Gandhimathi Appliances has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Butterfly Gandhimathi Appliances will earn in the future (free profit forecasts).

A Different Perspective

While the broader market lost about 5.2% in the twelve months, Butterfly Gandhimathi Appliances shareholders did even worse, losing 66%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.