If You Had Bought Canadian Pacific Railway (TSE:CP) Shares Three Years Ago You'd Have Made 45%

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, Canadian Pacific Railway Limited (TSE:CP) shareholders have seen the share price rise 45% over three years, well in excess of the market return (3.1%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 9.9% , including dividends .

View our latest analysis for Canadian Pacific Railway

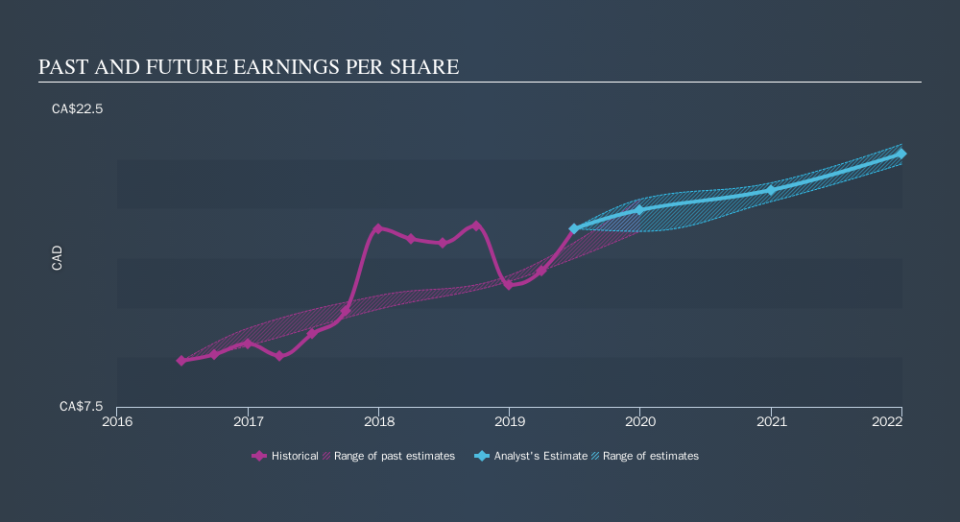

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Canadian Pacific Railway was able to grow its EPS at 19% per year over three years, sending the share price higher. The average annual share price increase of 13% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Canadian Pacific Railway's TSR for the last 3 years was 49%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Canadian Pacific Railway shareholders have received a total shareholder return of 9.9% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5.3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Canadian Pacific Railway by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.