If You Had Bought China High Speed Transmission Equipment Group (HKG:658) Stock A Year Ago, You'd Be Sitting On A 54% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. Anyone who held China High Speed Transmission Equipment Group Co., Ltd. (HKG:658) over the last year knows what a loser feels like. To wit the share price is down 54% in that time. However, the longer term returns haven't been so bad, with the stock down 23% in the last three years. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 7.7% in the same timeframe.

See our latest analysis for China High Speed Transmission Equipment Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

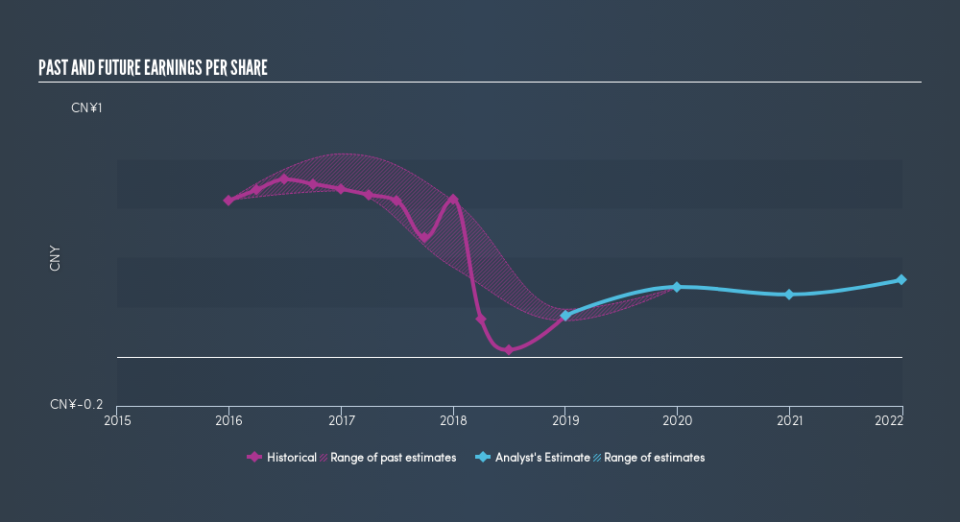

Unfortunately China High Speed Transmission Equipment Group reported an EPS drop of 74% for the last year. The share price fall of 54% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on China High Speed Transmission Equipment Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered China High Speed Transmission Equipment Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. China High Speed Transmission Equipment Group's TSR of was a loss of 53% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 3.2% in the twelve months, China High Speed Transmission Equipment Group shareholders did even worse, losing 53% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is China High Speed Transmission Equipment Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.