If You Had Bought Columbia Financial (NASDAQ:CLBK) Stock A Year Ago, You Could Pocket A 14% Gain Today

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Columbia Financial, Inc. (NASDAQ:CLBK) share price is up 14%, but that's less than the broader market return. We'll need to follow Columbia Financial for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Columbia Financial

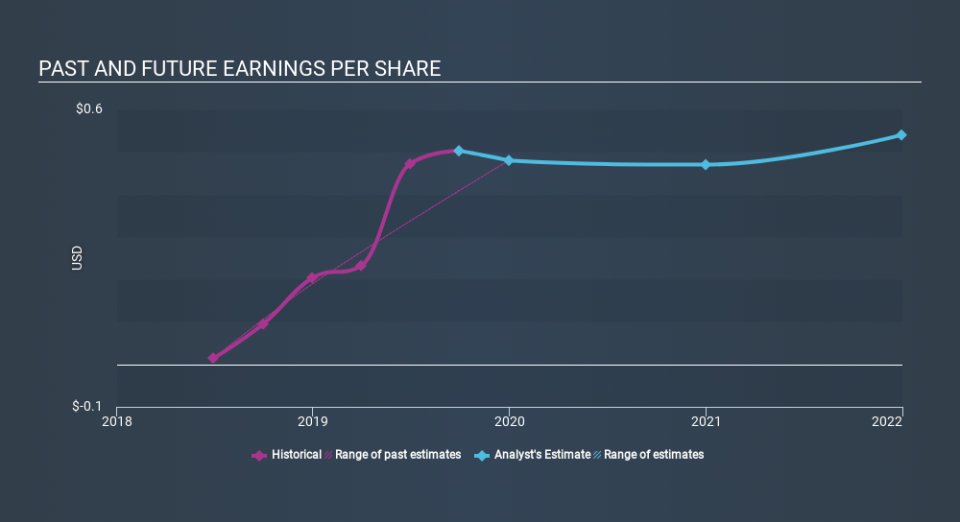

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Columbia Financial saw its earnings per share (EPS) increase strongly. This remarkable growth rate may not be sustainable, but it is still impressive. We are not surprised the share price is up. Strong growth like this can be evidence of a fundamental inflection point in the business, making it a good time to investigate the stock more closely.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Columbia Financial's earnings, revenue and cash flow.

A Different Perspective

Columbia Financial shareholders have gained 14% for the year. Unfortunately this falls short of the market return of around 24%. That's a lot better than the more recent three month gain of 0.06%, implying that share price has plateaued recently, for now. It's not uncommon to see a company's share price between updates to shareholders. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.