If You Had Bought Consti Yhtiöt Oyj (HEL:CONSTI) Stock Three Years Ago, You’d Be Sitting On A 49% Loss, Today

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that’s been the case for longer term Consti Yhtiöt Oyj (HEL:CONSTI) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 42%. The more recent news is of little comfort, with the share price down 32% in a year. And the share price decline continued over the last week, dropping some 6.5%.

Check out our latest analysis for Consti Yhtiöt Oyj

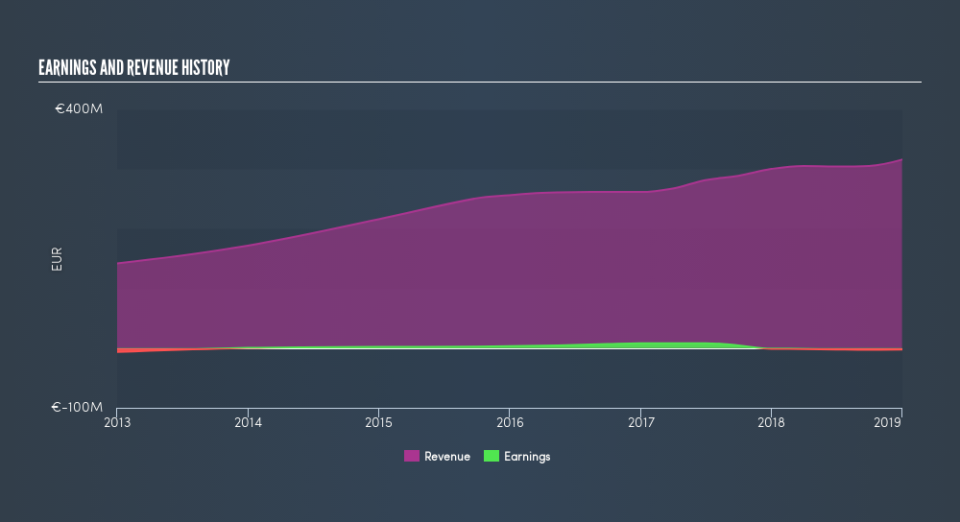

Given that Consti Yhtiöt Oyj didn’t make a profit in the last twelve months, we’ll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Consti Yhtiöt Oyj grew revenue at 7.7% per year. That’s not a very high growth rate considering it doesn’t make profits. Indeed, the stock dropped 20% over the last three years. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Dividend Lost

The share price return figures discussed above don’t include the value of dividends paid previously, but the total shareholder return (TSR) does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 3 years, Consti Yhtiöt Oyj generated a TSR of -46%, which is, of course, better than the share price return. Even though the company isn’t paying dividends at the moment, it has done in the past.

A Different Perspective

Over the last year, Consti Yhtiöt Oyj shareholders took a loss of 32%. In contrast the market gained about 8.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 18% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to ‘buy when there is blood on the streets’, he also focusses on high quality stocks with solid prospects. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.