If You Had Bought CorePoint Lodging's (NYSE:CPLG) Shares A Year Ago You Would Be Down 66%

The nature of investing is that you win some, and you lose some. And there's no doubt that CorePoint Lodging Inc. (NYSE:CPLG) stock has had a really bad year. In that relatively short period, the share price has plunged 66%. We wouldn't rush to judgement on CorePoint Lodging because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 23% in thirty days.

Check out our latest analysis for CorePoint Lodging

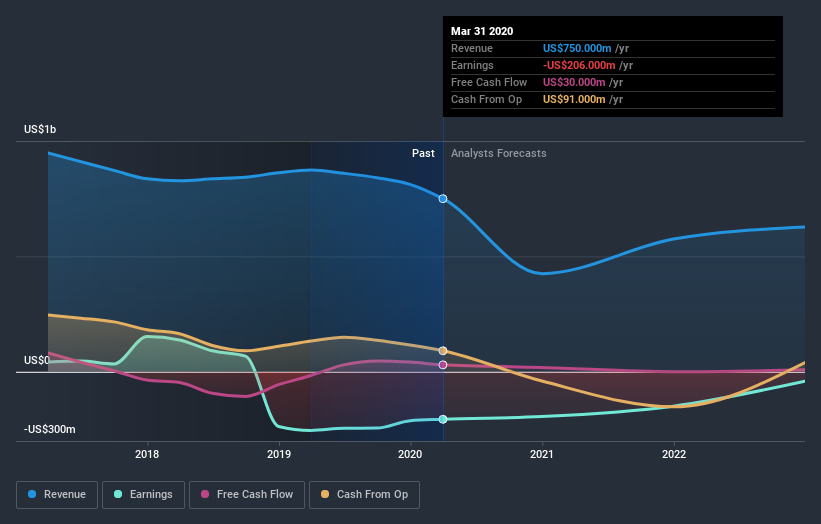

Because CorePoint Lodging made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

CorePoint Lodging's revenue didn't grow at all in the last year. In fact, it fell 14%. That's not what investors generally want to see. In the absence of profits, it's not unreasonable that the share price fell 66%. Fingers crossed this is the low ebb for the stock. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at CorePoint Lodging's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between CorePoint Lodging's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for CorePoint Lodging shareholders, and that cash payout explains why its total shareholder loss of 63%, over the last year, isn't as bad as the share price return.

A Different Perspective

Given that the market gained 9.0% in the last year, CorePoint Lodging shareholders might be miffed that they lost 63%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 8.4% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with CorePoint Lodging .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.