If You Had Bought COSCO SHIPPING Development (HKG:2866) Stock Five Years Ago, You'd Be Sitting On A 58% Loss, Today

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the COSCO SHIPPING Development Co., Ltd. (HKG:2866) share price managed to fall 58% over five long years. We certainly feel for shareholders who bought near the top.

Check out our latest analysis for COSCO SHIPPING Development

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, COSCO SHIPPING Development moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

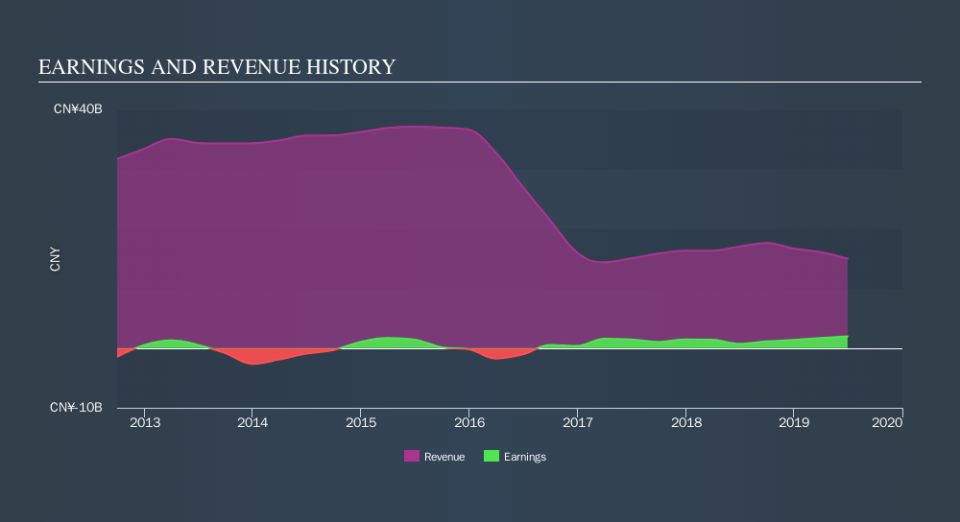

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. However, revenue has declined at a compound annual rate of 23% per year. With dividends up, but revenue down, some investors might be concluding that the company is no longer growing.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered COSCO SHIPPING Development's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that COSCO SHIPPING Development's TSR, which was a 57% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 1.8% in the twelve months, COSCO SHIPPING Development shareholders did even worse, losing 6.4% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 15% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Importantly, we haven't analysed COSCO SHIPPING Development's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.