If You Had Bought Covia Holdings (NYSE:CVIA) Stock A Year Ago, You'd Be Sitting On A 86% Loss, Today

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a Covia Holdings Corporation (NYSE:CVIA) shareholder over the last year, since the stock price plummeted 86% in that time. That'd be a striking reminder about the importance of diversification. Covia Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 47% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Covia Holdings

Covia Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

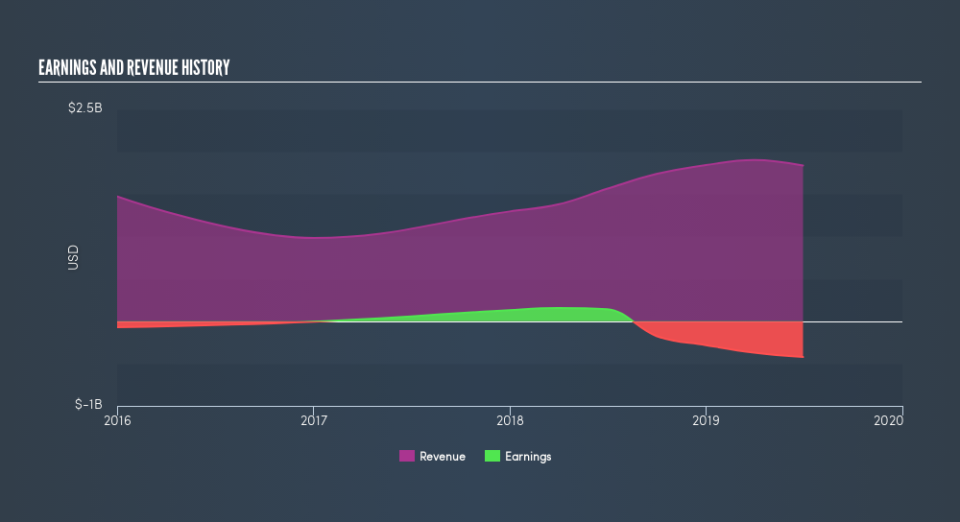

In the last twelve months, Covia Holdings increased its revenue by 18%. We think that is pretty nice growth. However, it seems like the market wanted more, since the share price is down 86%. One fear might be that the company might be losing too much money and will need to raise more. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Given that the market gained 0.5% in the last year, Covia Holdings shareholders might be miffed that they lost 86%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 47% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Covia Holdings by clicking this link.

Covia Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.