If You Had Bought Dah Sing Banking Group (HKG:2356) Stock A Year Ago, You'd Be Sitting On A 30% Loss, Today

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Dah Sing Banking Group Limited (HKG:2356) share price slid 30% over twelve months. That's disappointing when you consider the market returned -4.1%. At least the damage isn't so bad if you look at the last three years, since the stock is down 22% in that time. Furthermore, it's down 23% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Dah Sing Banking Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Dah Sing Banking Group share price fell, it actually saw its earnings per share (EPS) improve by 11%. Of course, the situation might betray previous over-optimism about growth. It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Dah Sing Banking Group's dividend seems healthy to us, so we doubt that the yield is a concern for the market. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

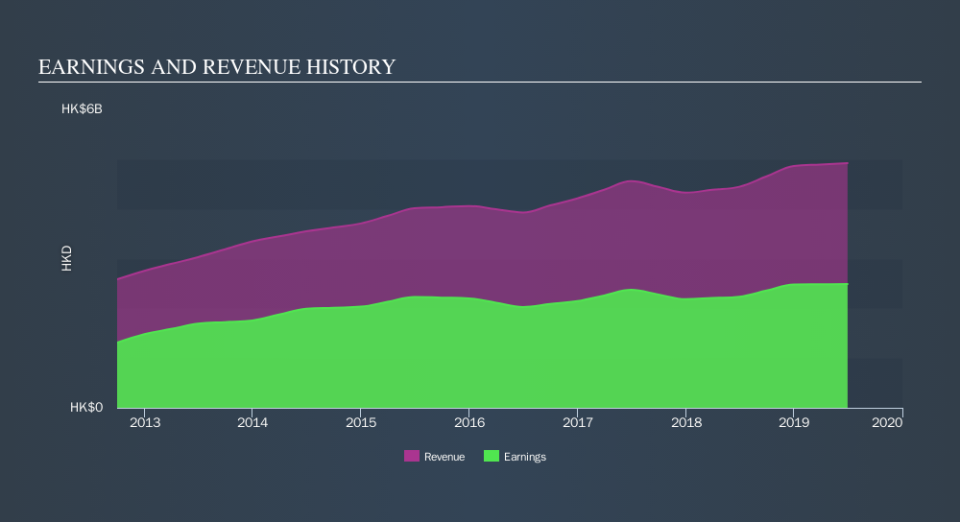

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Dah Sing Banking Group has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Dah Sing Banking Group

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Dah Sing Banking Group's TSR for the last year was -27%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 4.1% in the twelve months, Dah Sing Banking Group shareholders did even worse, losing 27% (even including dividends) . However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3.0% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Keeping this in mind, a solid next step might be to take a look at Dah Sing Banking Group's dividend track record. This free interactive graph is a great place to start.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.