If You Had Bought Damodar Industries (NSE:DAMOINDUS) Stock A Year Ago, You'd Be Sitting On A 40% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Damodar Industries Limited (NSE:DAMOINDUS) have tasted that bitter downside in the last year, as the share price dropped 40%. That's disappointing when you consider the market returned 0.3%. Damodar Industries may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Damodar Industries

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

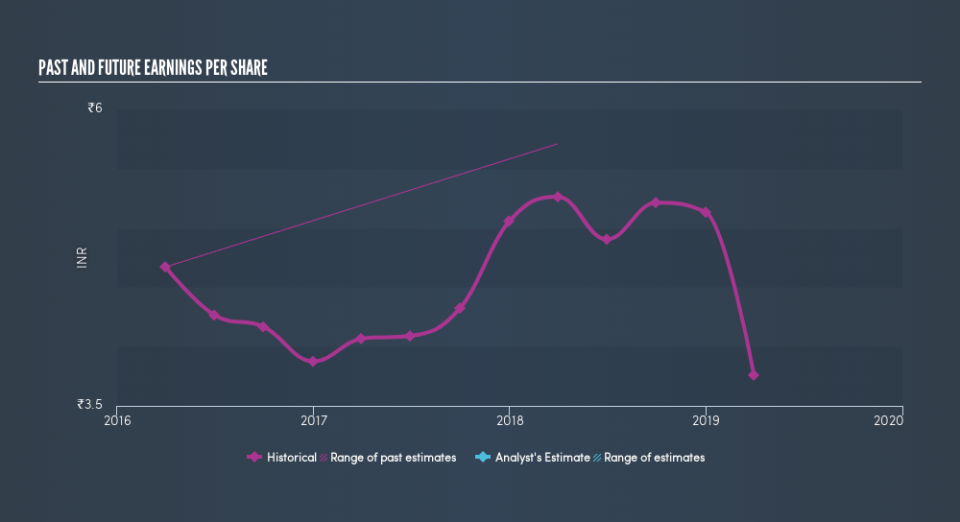

Unfortunately Damodar Industries reported an EPS drop of 29% for the last year. This reduction in EPS is not as bad as the 40% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 9.26 also points to the negative market sentiment.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Damodar Industries shareholders are down 38% for the year (even including dividends), the market itself is up 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 14% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you would like to research Damodar Industries in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Damodar Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.