If You Had Bought Dragon King Group Holdings (HKG:8493) Stock A Year Ago, You'd Be Sitting On A 54% Loss, Today

Investing in stocks comes with the risk that the share price will fall. Anyone who held Dragon King Group Holdings Limited (HKG:8493) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 54%. Dragon King Group Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 51% in the last 90 days.

See our latest analysis for Dragon King Group Holdings

Dragon King Group Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Dragon King Group Holdings saw its revenue fall by 0.5%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 54%. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

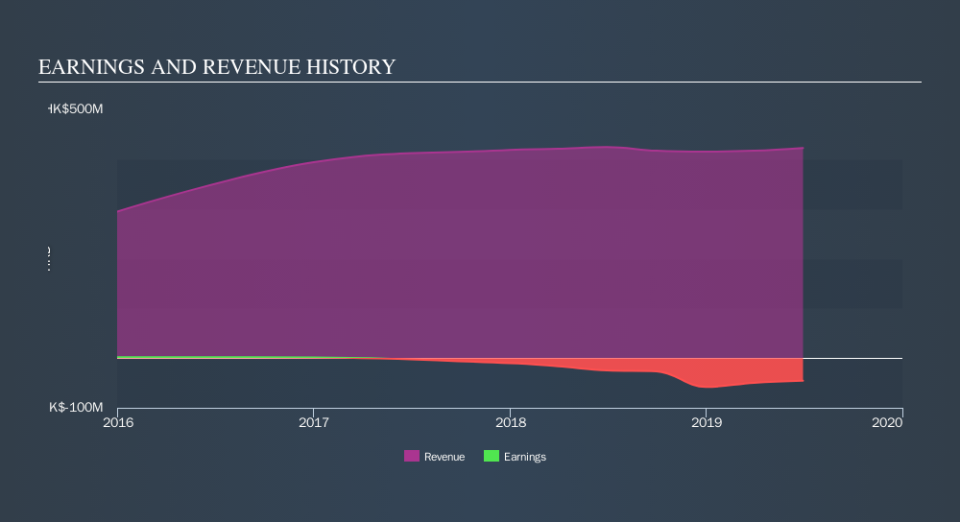

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Dragon King Group Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 4.0% in the last year, Dragon King Group Holdings shareholders might be miffed that they lost 54%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 51%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of Dragon King Group Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.