If You Had Bought Enanta Pharmaceuticals (NASDAQ:ENTA) Stock Three Years Ago, You Could Pocket A 84% Gain Today

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) shareholders have seen the share price rise 84% over three years, well in excess of the market return (20%, not including dividends).

Check out our latest analysis for Enanta Pharmaceuticals

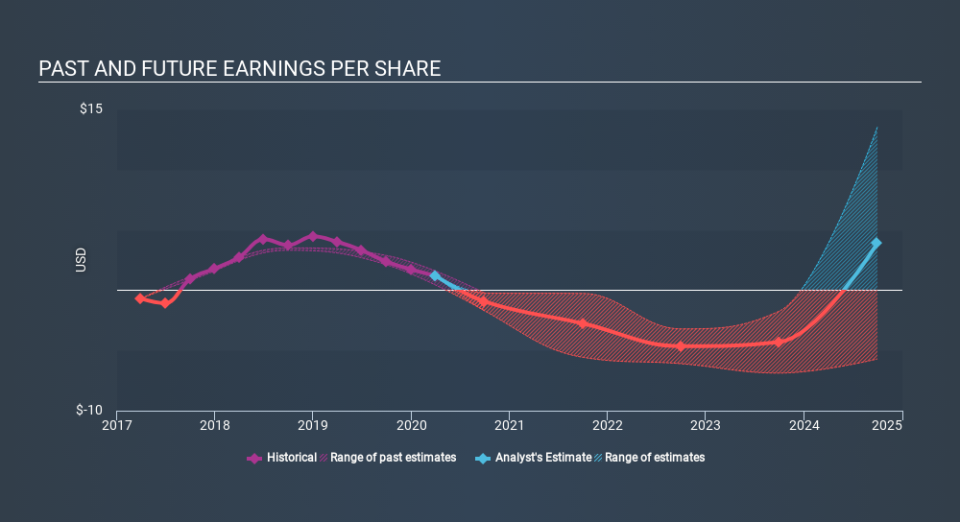

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Enanta Pharmaceuticals moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Enanta Pharmaceuticals has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Enanta Pharmaceuticals stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Enanta Pharmaceuticals shareholders are down 41% for the year, but the market itself is up 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 6.2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Enanta Pharmaceuticals has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.