If You Had Bought Fidia (BIT:FDA) Shares Five Years Ago You'd Have Made 49%

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Fidia share price has climbed 49% in five years, easily topping the market return of -34% (ignoring dividends).

View our latest analysis for Fidia

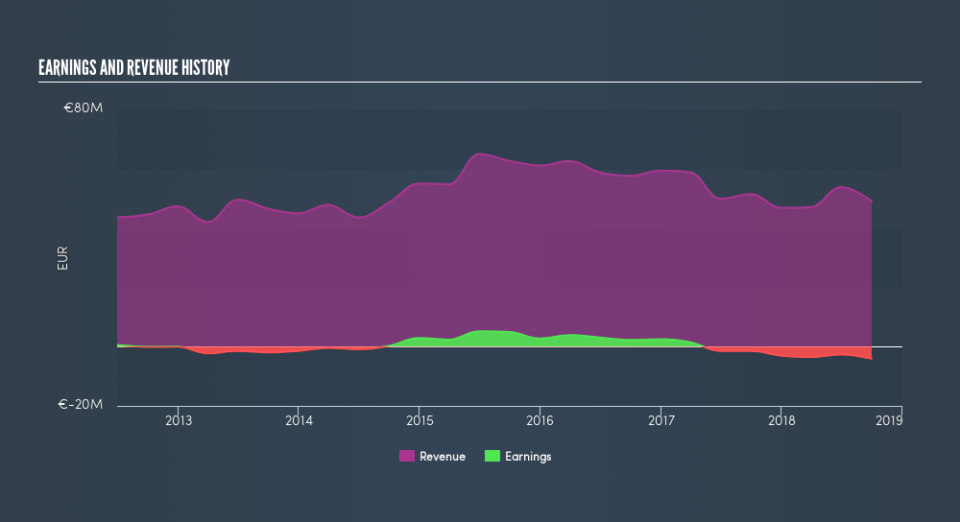

Because Fidia is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Fidia saw its revenue grow at 1.0% per year. That's not a very high growth rate considering the bottom line. The modest growth is probably broadly reflected in the share price, which is up 8.2%, per year over 5 years. The business could be one worth watching but we generally prefer faster revenue growth.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

If you are thinking of buying or selling Fidia stock, you should check out this FREE detailed report on its balance sheet.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Fidia's TSR over the last 5 years is 68%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

While the broader market lost about 4.2% in the twelve months, Fidia shareholders did even worse, losing 33%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before spending more time on Fidia it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.